Summary:

– Finland’s net borrowing requirement for 2025 is EUR 12.45 billion. With EUR 29.46 billion of redemptions the gross borrowing requirement amounts to EUR 41.90 billion.

– Approximately 55% of the next year’s gross funding will be funded with long-term maturities, the rest with Treasury bills.

– Three new euro benchmark bond syndications can be expected in 2025, out of which the first is likely in Q1.

– Auction dates for Q1 have been announced. ORI auctions will continue with six dates announced for the whole of 2025.

– Economic growth is exptected to accelerate next year driven by consumption and investments. Ministry of Finance predicts Finland’s GDP to grow by by 1.6% in 2025 and by 1.5% in 2026.

– Prefer to read this as PDF? Here it is.

Outlook for the Finnish economy and public finances

According to new forecast by the Ministry of Finance*, Finland’s GDP will contract this year by 0.3% even though the economy has grown in each quarter of this year compared with the previous one. Factors supporting the growth – inflation, interest rates, purchasing power – are foreseen to be strong enough to accelerate the growth to 1.6% in 2025 and to 1.5% in 2026 and 2027.

Growth in Finnish exports is picking up, but more slowly than expected due to contraction of goods trade within the Eurozone. Finnish exports have recovered over the past year driven by strong growth in services. Driven by this growth in services that is expected to continue, Finland’s total exports will increase by 3.4% in 2025 and by 3.1% in 2026.

Consumption and investments will support growth from 2025 as inflation slows down and interest rates fall. Real household income has started to increase, though this is yet to be reflected in an increase in consumption as household savings have increased significantly. This is expected to turn as lower interest rates will ease the debt servicing costs of mortgage borrowers, and employment improves. Employment recovery was delayed until 2025 in the new forecast.

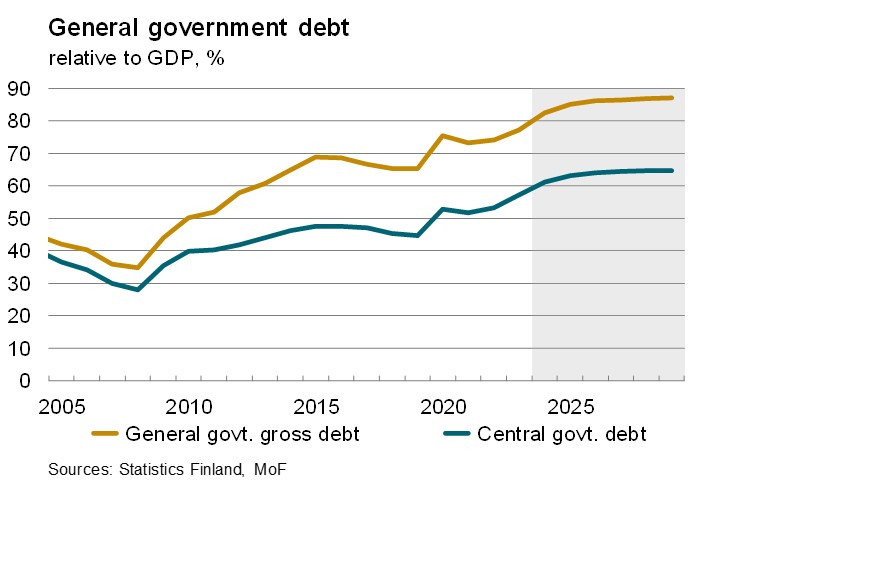

The general government deficit will be 4.2% of GDP in 2024. The deficit is projected to fall to 3.5% of GDP in 2025 and gradually to around 2% in 2029. Despite the deep deficits, Finland’s debt ratio shows signs of stabilising by the turn of the parliamentary term, given the Government’s EUR 9 billion fiscal consolidation is fully implemented as planned. The estimate for the central government debt at the end of 2024 is 61.2% in relation to GDP.

In 2025, the Republic of Finland will have solicited credit ratings from Fitch Ratings and Moody’s. Both agencies have currently assigned an AA+ credit rating for Finland’s long-term debt. Calendar dates for the rating announcements in 2025 will be published on the State Treasury’s website.

*Ministry of Finance, Economic Survey, Winter 2024.

Finland’s national climate action assessed for investors

Finland’s climate policies and ambitions have been assessed for the first time against the ASCOR framework, which is an investor-led initiative for making comparable assessments of sovereign debt issuers from a climate change perspective.

The assessment shows that the early net-zero target (of 2035), solid climate legislation and extensive carbon pricing are areas of strong performance. While Finland has reduced its absolute emissions by an annual average of –5.8% over the past five years, more ambition is needed globally as no country of the 70 assessed has a historical emissions trend or 2030 target that aligns with the 1.5°C benchmark.

The countries assessed against the ASCOR framework in 2024 represent 85% of global greenhouse gas emissions, 90% of global GDP and 100% of three main sovereign bond market indices.

Review of Treasury operations, October to December 2024

In Q4, the Republic of Finland conducted auctions of serial bonds and euro-denominated Treasury bills. The results of these auctions are summarised below.

| SERIAL BOND (RFGB) AND TREASURY BILL (RFTB) AUCTIONS IN Q4/2024 | |||||

| INSTRUMENT | AUCTION DATE | MATURITY | ISSUED AMOUNT (MEUR) | ISSUE YIELD | BID-TO-COVER |

| RFTB | 8 Oct 2024 | 13 May 2025 | 978 | 2.950% | 1.49 |

| RFTB | 8 Oct 2024 | 13 Aug 2025 | 1,000 | 2.825% | 1.63 |

| RFGB | 15 Oct 2024 | 15 Apr 2030 | 900 | 2.438% | 1.68 |

| RFGB | 15 Oct 2024 | 15 Sep 2034 | 600 | 2.713% | 2.35 |

| RFGB | 24 Oct 2024 | 15 Apr 2034 | 25 | 2.719% | 21.4 |

| RFGB | 24 Oct 2024 | 15 Sep 2040 | 351 | 3.029% | 1.34 |

| RFTB | 12 Nov 2024 | 13 May 2025 | 1,001 | 2.830% | 1.34 |

| RFTB | 12 Nov 2024 | 13 Aug 2025 | 1,001 | 2.630% | 1.29 |

| RFGB | 19 Nov 2024 | 15 Apr 2029 | 421 | 2.372% | 2.89 |

| RFGB | 19 Nov 2024 | 15 Sep 2034 | 414 | 2.763% | 2.47 |

| RFGB | 28 Nov 2024 | 15 Sep 2027 | 50 | 2.128% | 2.60 |

| RFGB | 28 Nov 2024 | 15 Apr 2055 | 200 | 2.870% | 1.55 |

In addition to auctions, the tap window for Treasury bill issuance in EUR and USD-denominated bills was open in October and November. Issuance volumes were EUR 2.0 billion and USD 0.8 billion in respective currencies with various maturities.

The budgeted gross borrowing in 2024 was EUR 42.219 billion, including EUR 11.967 billion of net borrowing. The realised borrowing exceeded the budgeted slightly as a larger cash buffer was needed at year end to safeguard sufficient liquidity. This raised the realised net borrowing of 2024 to EUR 12.579 billion, resulting in gross borrowing of EUR 42.832 billion.

Near-term outlook for the period of January to March 2025 and beyond

The most recent forecast for 2025 by the Ministry of Finance includes a net borrowing requirement of EUR 12.445 billion. With redemptions of EUR 29.455 billion the gross borrowing requirement amounts to EUR 41.900 billion. The funding strategy of the Republic of Finland remains the same as in 2024 given the similarity in funding amounts.

Approximately 55% of the gross funding required will be funded in long-term maturities, and the rest will be covered with short-term Treasury bills. During 2025, three new euro benchmark bonds can be expected. The first euro benchmark bond syndication is expected to take place in the first quarter of the year.

In addition to a new 10-year benchmark the State Treasury aims to issue a new 20-year benchmark during 2025, market conditions permitting. The exact maturity for the third syndication will be subject to market conditions while aiming at a balanced redemption profile, thus either the 7-year or 15-year segments could be considered. As in previous years, issues under the EMTN programme can complement the euro-denominated benchmark funding during the year, market conditions permitting.

Auctions of existing euro benchmark bonds will be conducted in 2025. Auction dates together with target volumes are published quarterly in advance on our website: Serial bond auctions. The first auction will take place on 18 February. Full details are published a few days prior to the auction date post market consultation. ORI (Optional reverse inquiry) auctions to support the secondary market liquidity of off-the-run bonds will continue with six calendar dates for 2025 now published.

The auctions of euro-denominated Treasury bills in the first quarter of the year will take place on 7 January, 11 February and 11 March. The auctions will be arranged in the Bloomberg Auction System and are open to the RFTB dealer group. Further information and a quarterly updated auction calendar will be published on our website: Treasury bill auctions.

To complement Treasury bill auctions, a sporadic issuance window may open during the first quarter of the year. The timing is subject to the liquidity position and refinancing needs of the central government. Treasury bills are issued in euros and US dollars.

The next Quarterly Review will be published on 31 March 2025.

Further information: Anu Sammallahti, Director of Finance, tel. +358 295 50 2575, firstname.lastname(at)statetreasury.fi