Summary:

– Long-term funding operations for 2024 are well advanced with all of the euro-denominated supply in syndicated form completed.

– Auction dates for Q4 have been published

– Government’s latest supplementary budget proposal for 2024 lowered the net borrowing requirement somewhat to EUR 11.859 billion, which implies gross borrowing of EUR 42.111 billion.

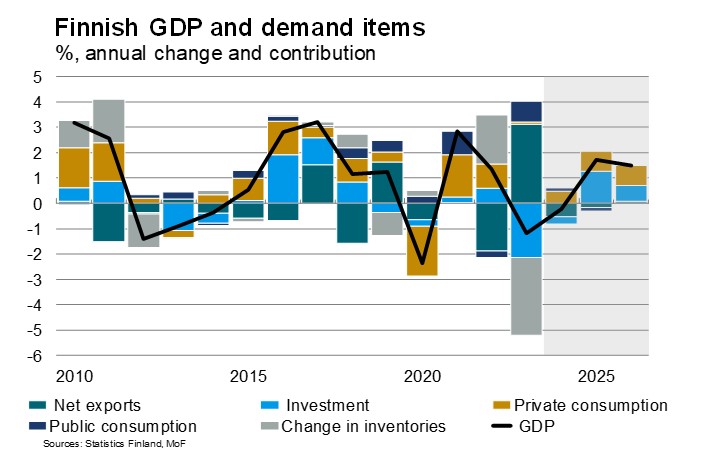

– Ministry of Finance expects Finland’s GDP to contract slightly this year, but return to growth next year. According to new forecast, Finnish economy will grow by 1.7% in 2025 and by 1.5% in 2026.

– Prefer to read the review as PDF? Here it is.

Outlook for the Finnish economy and public finances

The economy seems to have passed the lowest point of the economic cycle, and growth is expected to pick up in 2025. Though the economy grew slightly in the first half of the year, Finland’s gross domestic product (GDP) will decrease by 0.2% this year as a whole. In 2025, GDP growth will accelerate to 1.7% and in 2026, to 1.5%.

GDP growth is projected to gain speed in 2025, driven by slower inflation and lower interest rates that continue to boost household purchasing power and growth of private consumption. In 2025, lower interest rates will also help the construction sector, where the fall in investments has been particularly steep. Going forward, investment will also be boosted by the energy transition and the advancing digital transformation. Finnish exports are set to rise in the coming years, as the global economy and the EU market recover from recent sluggish growth.

The Ministry of Finance projects the general government deficit to be 3.7% of GDP this year, while the central government deficit will be 3.2% of GDP. The general government debt-to-GDP ratio will rise to over 80% this year, while the forecast for the central government debt ratio is 60.5%. A recovering economy and government’s fiscal consolidation measures – a package worth of EUR 9bn of spending cuts and structural reforms – will slow down the rise in the debt ratio from 2025 onwards, after which the debt ratio will stabilise at the turn of the parliamentary term.*

The central government of Finland has solicited credit ratings from Fitch Ratings and S&P Global Ratings. For long-term debt both agencies have assigned an AA+ credit rating. On August 9, Fitch Ratings changed the rating outlook from stable to negative. Calendar dates for the remaining credit rating announcements in 2024 are published on the State Treasury’s website on: Credit ratings. The State Treasury will also publish rating reports on the same site during the year.

In 2025, Finland’s GDP growth will be driven by investment and private consumption. Source: Ministry of Finance

Review of Treasury operations by the State Treasury, July to September 2024

On 20 August, Finland issued a new long 5-year, benchmark bond. The bond matures on 15 April 2030. The bond priced at 10 basis points over the euro swap curve, and the re-offer yield at issue was 2.550%. The syndication attracted strong demand from over 80 investors with the final order book closing in excess of EUR 10 billion. With its EUR 4bn deal size, the transaction was Finland’s largest print in the 5-year tenor in the last decade.

In Q3, the Republic of Finland conducted bond and Treasury bill auctions. Auction results are summarised below. These include an optional reverse inquiry (ORI) auction (on 29 August) to support the secondary market liquidity of off-the-run bonds.

In addition to auctions, the tap window for T-bill issuance in USD denominated bills was open in September, producing USD 2.1 billion of issuance with average maturity of 6 months.

| SERIAL BOND (RFGB) AND TREASURY BILL (RFTB) AUCTIONS IN Q3/2024 | |||||

| INSTRUMENT | AUCTION DATE | MATURITY | ISSUED AMOUNT (MEUR) | ISSUE YIELD | BID-TO-COVER |

| RFTB | 13 Aug 2024 | 13 Feb 2025 | 972 | 3.330% | 1.89 |

| RFTB | 13 Aug 2024 | 13 May 2025 | 976 | 3.140% | 1.77 |

| RFGB | 29 Aug 2024 | 15 Apr 2029 | 100 | 2.483% | 6.51 |

| RFGB | 29 Aug 2024 | 15 Sep 2029 | 301 | 2.491% | 5.65 |

| RFTB | 10 Sep 2024 | 13 May 2025 | 1,040 | 3.070% | 1.48 |

| RFTB | 10 Sep 2024 | 13 Aug 2025 | 960 | 2.895% | 1.47 |

| RFGB | 17 Sep 2024 | 15 Sep 2029 | 971 | 2.331% | 1.97 |

| RFGB | 17 Sep 2024 | 15 Apr 2034 | 530 | 2.581% | 1.92 |

Near-term outlook for the period of October to December 2024

The government’s third supplementary budget proposal for 2024 (dated 23 September) indicates a net borrowing requirement of EUR 11.859 billion which implies gross borrowing of EUR 42.111 billion. Long-term funding operations for 2024 are well advanced with all of the euro-denominated supply in syndicated form completed.

To complete the long-term funding requirement for the year, one or two more tap auctions of existing euro benchmark bond lines as well as two ORI auctions are expected to take place in the last quarter of the year. The next bond auction will take place on 15 October. Further details on the auction and an updated auction calendar are published on: Serial bond auctions.

As in previous years, bonds may be issued under the EMTN programme to complement the funding in euro benchmark bonds during the year, market conditions permitting.

The next auctions of euro-denominated Treasury bills are expected to take place on 8 October and 12 November. The auctions will be arranged in the Bloomberg Auction System and are open to the RFTB dealer group. Further information and a quarterly updated auction calendar will be published on: Treasury bill auctions.

In addition to Treasury bill auctions, a tap issuance window for bills is likely to open during the last quarter of the year. The timing of the Treasury bill issuance is subject to the liquidity position and refinancing needs of the central government. Treasury bills are issued in euros and US dollars.

The next Quarterly Review will be published on 20 December 2024.

Further information: Deputy Director Juha Savolainen, tel. +358 295 50 2905, or Senior Manager Mika Tasa at Treasury Front Office, tel. +358 295 50 2552, firstname.surname@statetreasury.fi