Summary:

– Long-term funding operations for 2023 are well advanced with all of the euro-denominated supply in syndicated form completed

– Auction dates for Q4 have been published

– Government’s latest supplementary budget proposal for 2023 indicates a net borrowing requirement of EUR 11.2 billion which implies gross borrowing of EUR 39.3 billion.

– Economic outlook has recently somewhat deteriorated, but GDP growth is expected to pick up slightly in 2024. The Ministry of Finance will release the next economic survey on 9 October.

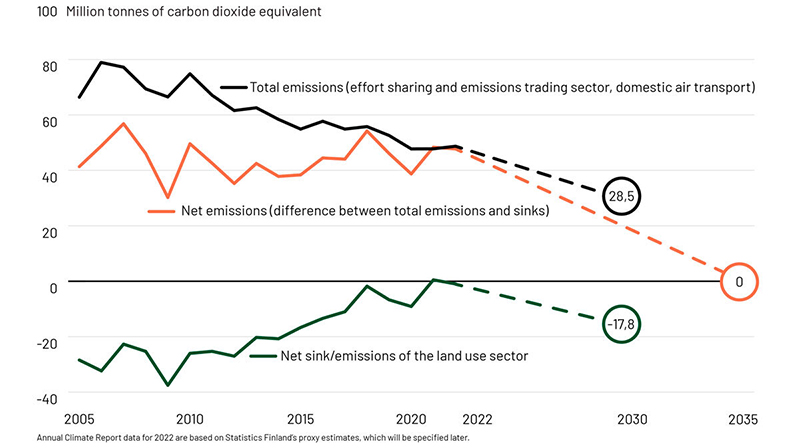

– According to Annual Climate Report 2023, Finland’s greenhouse gas emissions decreased by 4% in 2022 – but additional measures are needed to reach the national target of carbon neutrality in 2035.

– Prefer to read this as PDF? Here it is.

Outlook for the Finnish economy and public finances

In 2023, Finland’s GDP will remain at the previous year’s level, according to the forecast of the Ministry of Finance, released in June. In particular, rising prices and interest rates have this year slowed down household consumption and private investment in Finland.

GDP is projected to pick up slightly in 2024 as household purchasing power improves due to slowing of price inflation and rise of household income. In 2025 the Ministry of Finance expects economic growth to increase further, with domestic demand being supported by growth in consumption and investments related to the green transition. However, economic outlook has recently somewhat deteriorated, reflecting, among others, difficulties in the housing sector. The Ministry of Finance will release the next economic survey on 9 October.

The Ministry of Finance expects the general government deficit to be 2.4% this year, while the central government deficit will be 3.5% of GDP. The general government debt ratio has begun to increase again. The ratio of general government debt relative to GDP is expected to be 74% this year while the forecast for the central government debt is 54.4%. Forecasts do not yet include the upcoming measures outlined in the government programme that aim at strengthening general government finances, or the effects of the government’s budget proposal for 2024.

Source: Ministry of Finance: Economic Survey, June 2023.

Annual Climate Report 2023: Finland’s greenhouse gas emission decreased

Finland’s greenhouse gas emissions decreased by approximately 4% in 2022. Pursuant to the Finnish Climate Change Act, emissions must be reduced by 60% by 2030, using 1990 as the baseline – and based on current estimates, this target is possible to achieve. However, Finland’s target of carbon neutrality in 2035 requires additional measures particularly to strengthen the carbon sink of the land use sector. In 2035, emissions should be in balance with the sinks. Last year, Finland’s land use sector was a minor carbon sink.

Source: Ministry of the Environment: Annual Climate Report 2023

According to the Finnish Climate Change Act, Finland’s net emissions should be zero or negative by 2035. By 2030, emissions must be reduced by 60%, using 1990 as the baseline. It has been agreed at the EU level that the carbon sink of Finland’s land use sector must amount to -17.8 million tonnes of CO2-eq in 2030.

Review of Treasury operations by the State Treasury, July to September 2023

On 23 August, Finland issued a new 5-year, EUR 3 billion benchmark bond. The bond matures on 15 April 2029. The bond priced at 20 basis points below the euro swap curve, and the re-offer yield at issue was 2.991%. Over 80 investors participated in the deal, and the order book in the syndicated issue reached over EUR 11 billion. In bond issuances this year, especially central banks’ share of the investor allocations has been on a rising trend.

In Q3, the Republic of Finland conducted auctions of bonds and euro-denominated Treasury bills. The State Treasury introduced optional reverse inquiry (ORI) auctions in March to support the secondary market liquidity of off-the-run bonds by auctioning them in limited amounts. In the third quarter, one ORI auction took place on 17 August. The results of these actions are summarised in below.

| SERIAL BOND (RFGB) AND TREASURY BILL (RFTB) AUCTIONS IN Q3/2023 | |||||

| INSTRUMENT | AUCTION DATE | MATURITY | ISSUED AMOUNT | ISSUE YIELD | BID-TO-COVER |

| RFTB | 15 Aug 2023 | 13 Feb 2024 | 1,000 | 3.730% | 1.62 |

| RFTB | 15 Aug 2023 | 14 May 2024 | 1,000 | 3.760% | 1.51 |

| RFGB | 17 Aug 2023 | 15 Apr 2034 | 95 | 3.286% | 2.32 |

| RFGB | 17 Aug 2023 | 15 Apr 2052 | 192 | 3.224% | 2.82 |

| RFTB | 12 Sep 2023 | 14 May 2024 | 975 | 3.750% | 1.23 |

| RFTB | 12 Sep 2023 | 13 Aug 2024 | 1,002 | 3.710% | 1.47 |

| RFGB | 19 Sep 2023 | 15 Sep 2030 | 500 | 3.138% | 1.93 |

| RFGB | 19 Sep 2023 | 15 Sep 2033 | 941 | 3.264% | 1.26 |

In addition to auctions, the tap window for T-bill issuance in EUR denominated bills was open in September, producing EUR 2.369 billion of issuance with maturity of 6 months.

Near-term outlook for the period of October to December 2023

The government’s latest supplementary budget proposal for 2023 (dated 21 September) indicates a net borrowing requirement of EUR 11.2 billion which implies gross borrowing of EUR 39.3 billion. Long-term funding operations for 2023 are well advanced with all of the euro-denominated supply in syndicated form completed.

To complete the long-term funding requirement for the year, two more tap auctions of existing euro benchmark bond lines are expected to take place in the last quarter of the year. The next bond auction will take place on 17 October. Further details on the auction and an updated auction calendar are published on: Serial bond auctions.

As in previous years, bonds may be issued under the EMTN programme to complement the funding in euro benchmark bonds during the year, market conditions permitting.

The next auctions of euro-denominated Treasury bills are expected to take place on 10 October and 14 November. The auctions will be arranged in the Bloomberg Auction System and are open to the RFTB dealer group. Further information on Treasury bill auctions and a quarterly updated auction calendar will be published on: Treasury bill auctions.

In addition to Treasury bill auctions, a tap issuance window for bills is likely to open during the last quarter of the year. The timing of the Treasury bill issuance is subject to the liquidity position and refinancing needs of the central government. Treasury bills are issued in euros and US dollars.

The next Quarterly Review will be published on 22 December 2023.

Further information: Mika Tasa, Treasury Front Office, tel. +358 295 50 2552, firstname.surname@statetreasury.fi