Summary:

– State Treasury is planning to issue a new euro benchmark bond in Q3.

– Auction dates for Q3 have been published.

– At the end of Q2, approximately 71% of foreseen long-term funding has been completed.

– The economic outlook is improving and growth is expected to strengthen towards the end of the year. While Finland’s GDP will remain at the previous year’s level in 2024, the economy is projected to grow by 1.6% in 2025 and by 1.5% in 2026.

– Finland’s greenhouse gas emissions decreased by -11% in 2023 due to changes in the structure of domestic electricity production, especially increased production of nuclear power and wind power.

– Prefer to read the review in PDF? Here it is.

Outlook for the Finnish economy and public finances

Finland is gradually moving out of recession. The economy grew slightly in the first quarter of 2024 and growth is expected to strengthen towards the end of the year, driven by a recovery in demand as inflation and interest rates fall. This year Finland’s GDP will still remain at the previous year’s level, but in 2025 the economy will grow by 1.6% and in 2026 by 1.5%, according to latest forecast.

Inflation has slowed considerably and is expected to remain low. In 2025, private consumption is foreseen to grow rapidly as interest rates continue to fall, consumer confidence picks up and employment situation improves. As the world trade recovers, Finnish exports are expected grow in its wake, supported by good cost competitiveness. Employment will decline this year but will resume growth again once the economy recovers and the supply of labour is increased by Government’s employment measures and by immigration.

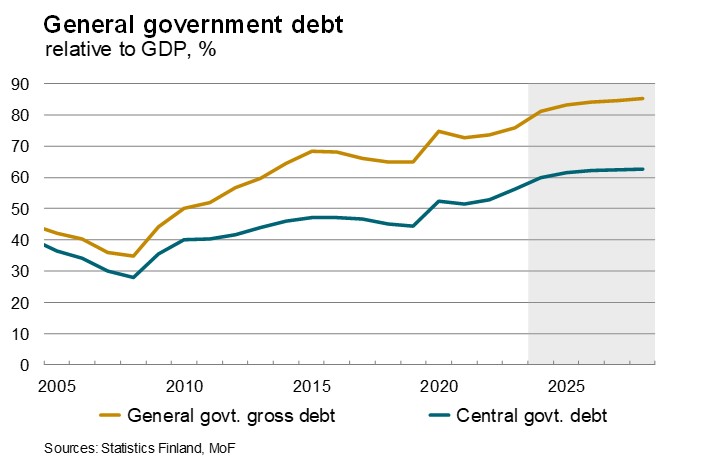

The Ministry of Finance expects the general government deficit to be 3.7% of GDP this year, 3.1% in 2025 and 2.6% in 2026. Forecast for general government finances has thus deteriorated somewhat since spring, but the deficits are expected to start gradually becoming smaller. General government finances will also be strengthened by the EUR 9 billion of fiscal consolidation measures decided by the Government. This year, general government debt is expected to be 81% relative to GDP while the forecast for the central government debt is 60%.[1]

Finland’s relatively strong public finances and modern economy, among many other things, have traditionally been reflected in the high credit ratings of the central government. The central government of Finland has solicited credit ratings from Fitch Ratings and S&P Global Ratings. For long-term debt both agencies have assigned an AA+ credit rating with a stable outlook. Calendar dates for credit rating announcements in 2024 are published on the State Treasury’s website on: Credit ratings. The State Treasury will also publish rating reports on the same site during the year.

[1] All views are from the Economic Survey, Summer 2024, Ministry of Finance

Finland’s greenhouse gas emissions down by -11% last year

According to the Annual Climate Report 2024, clean energy transition makes good progress but further action is needed to reach climate targets.

In 2023, Finland’s greenhouse gas emissions were significantly lower than in the previous year with emissions from energy production decreasing by more than expected (-19%). However, more action will be needed in all sectors to reach the national as well as EU level obligations especially in the land use and effort sharing sectors. Finland aims to be carbon neutral by 2035.

Review of Treasury operations by the State Treasury, April to June 2024

A new euro benchmark bond was launched on 23 April. The new 10-year bond maturing on 15 September 2034 with an issue size of EUR 4 billion was priced at 20 basis points over the euro swap curve. Over 160 investors participated in the issue. The bond has a coupon of 3%, and yield at issue was 3.016%.

On June 25, Republic of Finland raised USD 1 billion with a dollar denominated bond issue maturing on 2 June 2034. The high-quality order book amounted to 1.1 billion and the re-offer yield on the bond was 4.399%. Dollar denominated issuance is launched under the Medium Term Note issuance programme and aims to diversify the investor base in addition to providing cost-efficient funding.

In Q2, the Republic of Finland conducted bond and Treasury bill auctions. The auction results are summarised below. These include two optional reverse inquiry (ORI) auctions – on April 4 and May 30 -to support the secondary market liquidity of off-the-run bonds.

In addition to auctions, the tap window for T-bill issuance in EUR denominated bills was open in April and June, producing 0.2 billion of issuance.

| SERIAL BOND (RFGB) AND TREASURY BILL (RFTB) AUCTIONS IN Q2/2024 | |||||

| INSTRUMENT | AUCTION DATE | MATURITY | ISSUED AMOUNT (MEUR) | ISSUE YIELD | BID-TO-COVER |

| RFGB | 4 Apr 2024 | 15 Sep 2032 | 185 | 2.811% | 2.09 |

| RFGB | 4 Apr 2024 | 4 Jul 2042 | 170 | 3.083% | 1.21 |

| RFTB | 9 Apr 2024 | 13 Nov 2024 | 990 | 3.680% | 1.80 |

| RFTB | 9 Apr 2024 | 13 Feb 2025 | 1,000 | 3.545% | 1.44 |

| RFGB | 16 Apr 2024 | 15 Apr 2029 | 805 | 2.762% | 1.35 |

| RFGB | 16 Apr 2024 | 15 Apr 2055 | 580 | 3.125% | 1.45 |

| RFTB | 14 May 2024 | 13 Nov 2024 | 817 | 3.650% | 2.02 |

| RFTB | 14 May 2024 | 13 Feb 2025 | 1,147 | 3.570% | 1.56 |

| RFGB | 21 May 2024 | 15 Apr 2029 | 771 | 2.854% | 1.45 |

| RFGB | 21 May 2024 | 15 Sep 2034 | 715 | 2.996% | 1.73 |

| RFGB | 30 May 2024 | 15 Apr 2026 | 190 | 3.190% | 2.06 |

| RFGB | 30 May 2024 | 15 Apr 2047 | 193 | 3.295% | 1.60 |

| RFTB | 4 Jun 2024 | 13 Feb 2025 | 984 | 3.560% | 1.77 |

| RFTB | 4 Jun 2024 | 13 May 2025 | 1,018 | 3.485% | 1.54 |

| RFGB | 11 Jun 2024 | 15 Sep 2034 | 856 | 3.262% | 1.19 |

| RFGB | 11 Jun 2024 | 15 Apr 2055 | 640 | 3.389% | 1.34 |

Near-term outlook for the period of July to September 2024

In the government budget, the net borrowing requirement for 2024 is EUR 12.739 billion. The gross borrowing amount in 2024 is EUR 42.922 billion. At the end of the second quarter, approximately 71% of foreseen long-term funding has been completed.

The State Treasury is planning to issue a new euro benchmark bond in Q3, likely in August – September. A potential maturity of the bond is foreseen in the 5-7 year sector. If market conditions were to prove favorable for a longer maturity, e.g. 15 years, that could be considered.

The next bond auction will take place on 17 September. Further details on the auction and an updated auction calendar are published on: Serial bond auctions. The auction calendar for Q3 includes an optional serial bond auction (ORI) on 29 August.

The next auctions of euro-denominated Treasury bills will take place on 13 August and 10 September. The auctions will be arranged in the Bloomberg Auction System and are open to the RFTB dealer group. Further information and a quarterly updated auction calendar will be published on: Treasury bill auctions.

In addition to auctions, an issuance window for bills is likely to open during the second half of the year. The timing of the Treasury bill issuance is subject to the liquidity position and refinancing needs of the central government. Treasury bills are issued in euros and US dollars.

The next Quarterly Review will be published on 30 September 2024.

Further information: Deputy Director Anu Sammallahti at the Treasury Front Office, tel. +358 295 50 2575, firstname.lastname(at)statetreasury.fi