Summary:

– In Q2, the State Treasury is planning to issue a second new euro benchmark bond of the year, likely in a 10-year maturity.

– Auction dates for Q2 have been published

– 60% of the annual long-term funding is expected to be completed by the end of June.

– Finnish economy is recovering from recession. Recent GDP growth forecasts for 2025 have ranged from 0.8% to 1.6% and for 2026 from 1.4% to 1.8%. Ministry of Finance will publish its next forecast on 30 April.

– The Finnish government will negotiate on the General Government Fiscal Plan for 2026-2029 during its mid-term budget negotiations on 22-23 April.

– Prefer to read the review as PDF? Here it is.

Outlook for the Finnish economy and public finances

After a modest 2024 when the Finnish GDP stayed still, economic growth is expected to gradually strengthen this year. Uncertainty surrounding the global economy and Finland’s economic environment have increased in the previous months, however, the future outlook has remained somewhat unchanged in some of the most recent forecasts for the Finnish economy. Finland’s economy is recovering from a recession, and GDP growth forecasts for 2025 and 2026 include:

– 1.6% / 1.5% (from Ministry of Finance; numbers from the December forecast)

– 0.8% / 1.8% (from the Bank of Finland)

– 1.1% / 1.8% (from Danske Bank)

– 1.2% / 1.4% (from ETLA Economic Research).

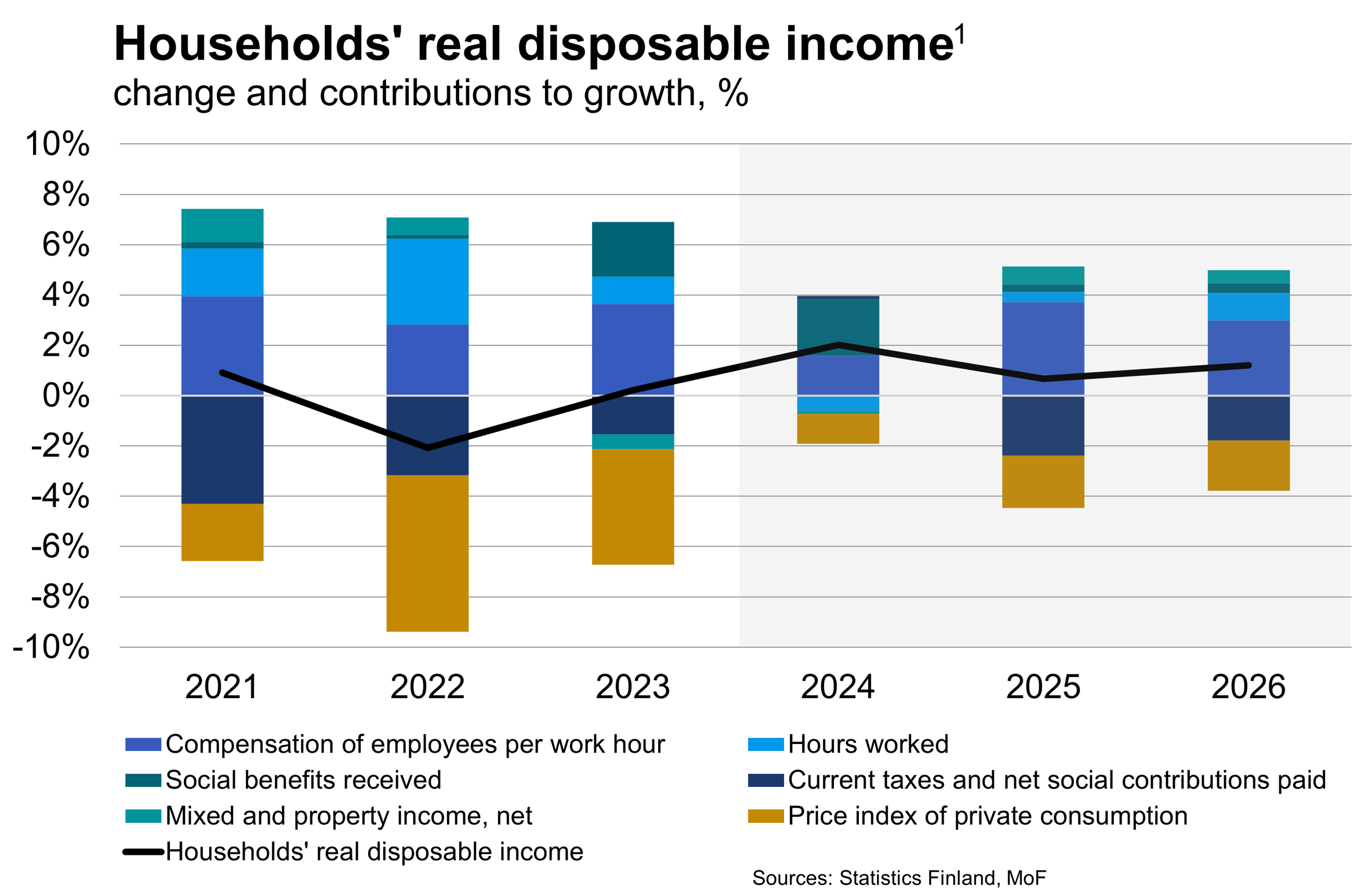

Growth is expected to pick up this year as purchasing power increases and interest rates continue to fall, which will support consumption and investment. Falling interest rates are particularly meaningful for the Finnish economy given the high proportion of variable-rate mortgages and corporate loans. However, the recovery will be slow with GDP growth projected to remain subdued in early 2025 as consumer confidence remains weak and unemployment is still rising. The unemployment rate has risen by almost 3 percentage points from its low in spring 2022, reaching 9.1% in February. As economic growth gains momentum, the unemployment rate will gradually start to decline.

Low inflation continues to boost purchasing power. At 1.5% in February 2025, the rate of inflation in Finland remains way below the euro area average (2.4%), driven by declining energy prices and lower labour cost pressures, among other reasons.

The Finnish government will negotiate on the General Government Fiscal Plan for 2026-2029 during its mid-term budget negotiations on 22-23 April. The government’s fiscal policy target is to stabilise the general government debt ratio by the end of its term in 2027. A fiscal consolidation package worth of EUR 9bn (approx. 3% relative to GDP), consisting of spending cuts, tax measures and structural reforms is already in implementation. In the mid-term negotiations, the Finnish government is expected to address economic growth measures and defence spending, among other issues. The Ministry of Finance will publish its spring forecast for the Finnish economy on 30 April.

Finland’s competitive economy and strong institutions, among other things, have traditionally been reflected in the high credit ratings of the central government. The central government of Finland has solicited credit ratings from Fitch Ratings and Moody’s Ratings. For long-term debt the agencies have assigned an AA+ (Fitch) / Aa1 (Moody’s) for the rating. Calendar dates for their rating announcements are published on the State Treasury’s central government debt management website on: Credit Ratings. The State Treasury also publishes several other rating reports on the same website during the year.

Source: Economic Survey, Winter 2024. Ministry of Finance.

Review of Treasury operations by the State Treasury, January to March 2025

Republic of Finland’s first syndicated issue of the year on 22 January was a new EUR 3 billion benchmark bond maturing on 15 April 2045. The 20-year tenor attracted record demand with an order book in excess of EUR 31 billion from more than 220 investors. This is the largest book and the highest number of investors ever for Finland’s syndicated transactions. The bond was priced at 75 bps over the euro mid-swap curve with a re-offer yield of 3.205%.

In Q1, the Republic of Finland conducted auctions of serial bonds and euro-denominated Treasury bills. The results of these auctions are summarised below. These include an optional reverse inquiry (ORI) serial bond auction conducted on 6 February.

In addition to auctions, the tap window for Treasury bill issuance in EUR denominated bills was open in January. Issuance volume in tap format was 400 million.

| SERIAL BOND (RFGB) AND TREASURY BILL (RFTB) AUCTIONS IN Q1/2025 | |||||

| INSTRUMENT | AUCTION DATE | MATURITY | ISSUED AMOUNT (MEUR) | ISSUE YIELD | BID-TO-COVER |

| RFTB | 7 Jan 2025 | 13 Aug 2025 | 801 | 2.515% | 2.28 |

| RFTB | 7 Jan 2025 | 13 Nov 2025 | 1,200 | 2.478% | 1.74 |

| RFGB | 6 Feb 2025 | 15 Apr 2029 | 227 | 2.368% | 7.89 |

| RFGB | 6 Feb 2025 | 15 Sep 2032 | 175 | 2.626% | 5.00 |

| RFTB | 11 Feb 2025 | 13 Aug 2025 | 1,008 | 2.350% | 1.91 |

| RFTB | 11 Feb 2025 | 13 Nov 2025 | 994 | 2.260% | 1.59 |

| RFGB | 18 Feb 2025 | 15 Apr 2030 | 722 | 2.494% | 1.69 |

| RFGB | 18 Feb 2025 | 15 Sep 2034 | 778 | 2.854% | 1.5 |

| RFTB | 11 Mar 2025 | 13 Nov 2025 | 685 | 2.270% | 2.29 |

| RFTB | 11 Mar 2025 | 13 Feb 2026 | 1,317 | 2.290% | 1.4 |

| RFGB | 18 Mar 2025 | 15 Sep 2034 | 773 | 3.164% | 1.92 |

| RFGB | 18 Mar 2025 | 15 Apr 2038 | 728 | 3.402% | 1.76 |

Near-term outlook for the period of April to June 2025

According to the first supplementary budget proposal by the government for 2025, dated 27 February, the net borrowing requirement is estimated at EUR 12.289 billion, resulting in a gross borrowing amount of EUR 41.744 billion. Approximately EUR 24.3 billion of this amount is expected to be covered with long-term debt, and the rest (17.4 billion) with short-term debt.

In Q2, the State Treasury is planning to issue a second new euro benchmark bond, which may have a 10-year maturity. The long-term funding operations are expected to include three euro benchmark bond tap auctions during the quarter. The State Treasury estimates to complete about 60% of the above annual long-term funding by the end of June.

The next bond auction is expected to take place on 15 April 2025. Further details on the auction and an updated auction calendar are published on: Serial Bond Auctions. The auction calendar for Q2 includes two ORI serial bond auction dates.

As in previous years, bonds may be issued under the EMTN programme to complement the funding in euro benchmark bonds during the year, market conditions permitting.

The next auction of euro-denominated Treasury bills will take place on 8 April 2025. The auction will be arranged in the Bloomberg Auction System and is open to the RFTB dealer group. Further information on Treasury bill auctions and a quarterly updated auction calendar will be published on: Treasury bill auctions.

In addition to Treasury bill auctions, a tap issuance window may open during the second quarter of the year. The timing of the Treasury bill issuance is subject to the liquidity position and refinancing needs of the central government. Treasury bills are issued in euros and US dollars.

The next Quarterly Review will be published on 27 June 2025.

Further information: Head of Debt Management Anu Sammallahti, tel. +358 295 50 2575, or Head of Funding Jussi Tuulisaari at Treasury Front Office, tel. +358 295 50 2616, firstname.surname(a)statetreasury.fi