Summary:

– In Q2, the State Treasury is planning to issue a second new euro benchmark bond

– Auction dates for Q2 have been published

– Almost 70 per cent of the annual long-term funding is expected to be completed by the end of June

– Finland’s debt management strategy has been updated. The average fixing of central government debt will be lengthened moderately in 2024–2028. This will be achieved by not entering into new interest rate swaps; borrowing strategy is not affected.

– Finnish economy is in recession but the future outlook remains unchanged – growth is expected to pick up in the second half of the year. Ministry of Finance will publish its next forecast on 25 April.

– Prefer to read the review in PDF? Here it is.

Outlook for the Finnish economy and public finances

According to preliminary data by Statistics Finland, the Finnish economy contracted by 1.0% in 2023. The economy is in recession with high interest rates, a downturn in the housing market, weak trade-partner growth and, most recently, the ongoing political strikes all weighing on activity. However, the future outlook remains unchanged in the recent forecasts. A shallow recovery is expected in the second half of year as inflation slows down, interest rates fall and household purchasing power improves. After a modest 2024, economic growth will strengthen in 2025.

Inflationary pressures are diminishing. Inflation is at 1.1% among the lowest in eurozone and it is estimated to decline further during 2024.

The labour market has been resilient in relation to economic conditions, but employment has started to decline. The dip is expected to be temporary. The number of people in employment will begin to grow as the economy returns to growth and as the first set of Government measures to increase labour supply start to take effect.

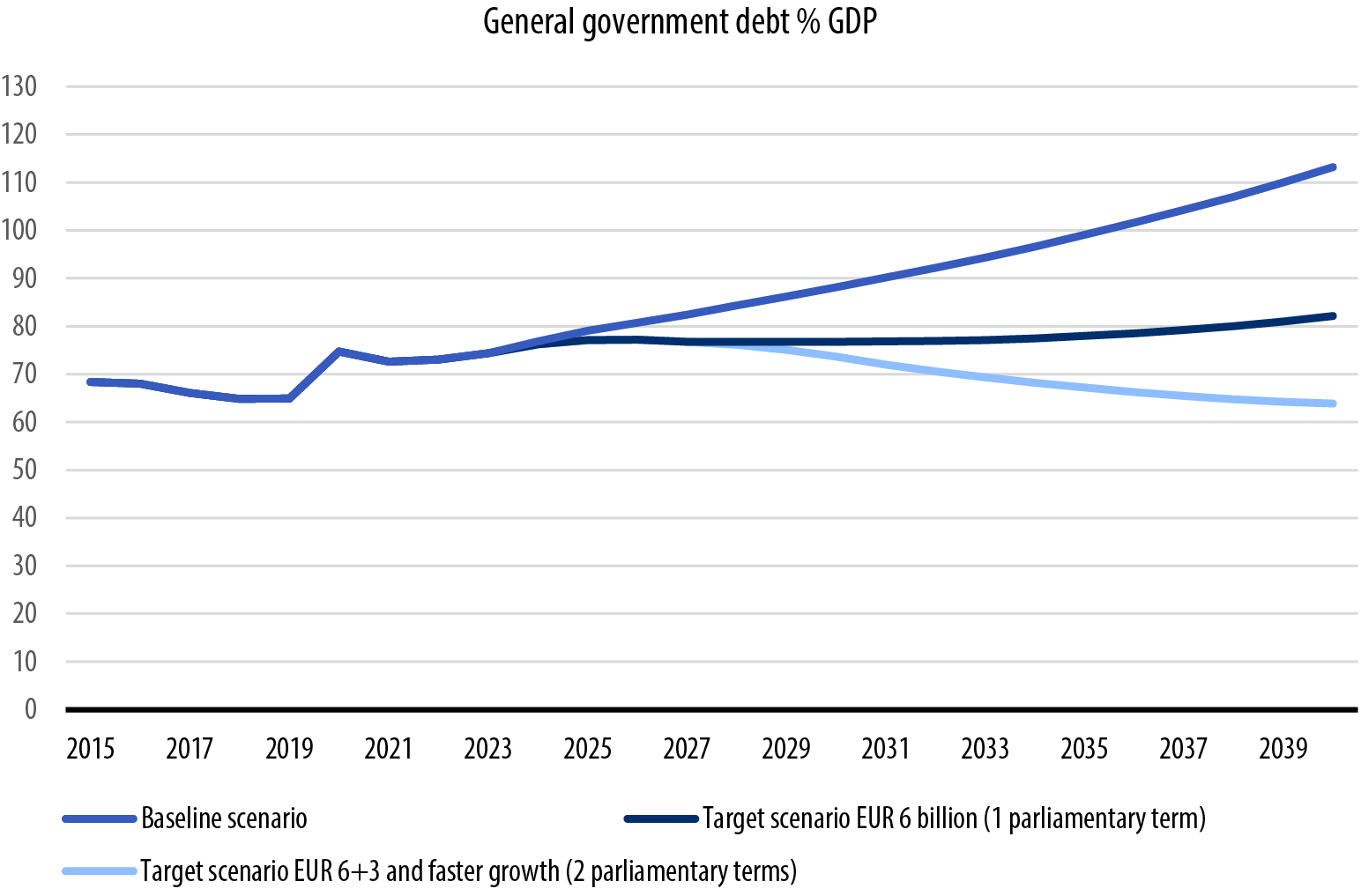

Finnish government’s fiscal policy target is to strengthen general government finances by EUR 6 billion by 2027 and thus reverse the trend of Finland’s indebtedness. Of the EUR 6 billion consolidation package, EUR 4 billion will be direct spending cuts and EUR 2 billion measures to boost employment. Very recent estimate of the employment and fiscal effects of the bills already submitted to the Parliament are about 74,000 jobs, strengthening the public finances by about EUR 1.7 billion. Fiscal consolidation is advancing as planned but as the economy’s performance has been weaker than expected, the Government is preparing new measures to be announced after its budget negotiations in mid-April. The next economic forecast by the Ministry of Finance will be published on 25 April.

Starting point of the Finnish Government’s economic policy target. The graph is from June, 2023. Source: Government Programme

Ministry of Finance publishes medium-term strategy for debt management 2024–2028

Finland’s government debt management strategy has been updated. The key change is to gradually reduce the expected volatility in interest expenditure by lengthening the average fixing of central government debt by approximately two years during the strategy period 2024–2028. This will be achieved under the existing borrowing strategy by no longer entering into new interest rate swaps. Guidelines for the central government liquidity management have also been revised with considerations for both liquidity and credit risks. Ministry of Finance cited several changes in the debt management operating environment as reasons behind the update in its announcement on 8 March.

Review of Treasury operations by the State Treasury, January to March 2024

The first syndicated issue of the year on 17 January was a new EUR 3 billion benchmark bond maturing on 15 April 2055. The 30-year tenor attracted an order book of over EUR 9 billion, and over 100 investors participated in the deal. The bond was priced 56 basis points over the euro mid-swap curve with a re-offer yield of 2.971%.

In Q1, the Republic of Finland conducted auctions of serial bonds and euro-denominated Treasury bills. The results of these auctions are summarised below. These include an optional reverse inquiry (ORI) serial bond auction conducted on 8 February. The State Treasury introduced ORI-auctions in 2023 to facilitate auctioning off-the-run bonds in limited amounts to support their market liquidity.

In addition to auctions, the tap window for Treasury bill issuance in EUR and USD-denominated bills was open on numerous occasions. Issuance volumes in tap format were EUR 5.2 billion and USD 1.2 bn in respective currency. Average maturity for EUR-denominated bills was 8.6 and for USD-denominated 12 months.

| SERIAL BOND (RFGB) AND TREASURY BILL (RFTB) AUCTIONS IN Q1/2024 | |||||

| INSTRUMENT | AUCTION DATE | MATURITY | ISSUED AMOUNT (MEUR) | ISSUE YIELD | BID-TO-COVER |

| RFTB | 9 Jan 2024 | 13 Aug 2024 | 1,001 | 3.660% | 1.55 |

| RFTB | 9 Jan 2024 | 13 Nov 2024 | 1,000 | 3.465% | 1.39 |

| RFGB | 8 Feb 2024 | 15 Sep 2028 | 151 | 2.595% | 4.01 |

| RFGB | 8 Feb 2024 | 15 Apr 2034 | 251 | 2.863% | 2.55 |

| RFTB | 13 Feb 2024 | 13 Aug 2024 | 1,001 | 3.780% | 2.26 |

| RFTB | 13 Feb 2024 | 13 Nov 2024 | 1,000 | 3.630% | 1.96 |

| RFGB | 20 Feb 2024 | 15 Apr 2029 | 751 | 2.694% | 1.58 |

| RFGB | 20 Feb 2024 | 15 Sep 2033 | 751 | 2.833% | 1.95 |

| RFTB | 12 Mar 2024 | 13 Nov 2024 | 1,000 | 3.685% | 2.25 |

| RFTB | 12 Mar 2024 | 13 Feb 2025 | 1,001 | 3.540% | 1.64 |

| RFGB | 19 Mar 2024 | 15 Apr 2029 | 531 | 2.740% | 1.99 |

| RFGB | 19 Mar 2024 | 15 Sep 2033 | 970 | 2.872% | 1.34 |

Near-term outlook for the period of April to June 2024

According to the latest supplementary budget proposal by the government for the year, dated 21 March, the net borrowing requirement is estimated at EUR 12.933 million, resulting in a gross borrowing amount of EUR 43.185 billion. Approximately EUR 22.5 billion of this amount is expected to be covered with long-term debt, and the rest (20.7 billion) with short-term debt.

In the second quarter of the year, the State Treasury is planning to issue a second new euro benchmark bond, which may have a 10-year maturity. If market conditions were to prove favorable for a longer maturity, e.g. 15 years, that could be considered. The long-term funding operations are expected to include three euro benchmark bond tap auctions during the quarter. The State Treasury estimates to complete about 70 per cent of the above annual long-term funding by the end of June.

The next bond auction is expected to take place on 16 April 2024. Further details on the auction and an updated auction calendar are published on: Serial Bond Auctions. The auction calendar for Q2 includes two ORI serial bond auction dates.

As in previous years, bonds may be issued under the EMTN programme to complement the funding in euro benchmark bonds during the year, market conditions permitting.

The next auction of euro-denominated Treasury bills will take place on Tuesday 9 April 2024. The auction will be arranged in the Bloomberg Auction System and is open to the RFTB dealer group. Further information on Treasury bill auctions and a quarterly updated auction calendar will be published on: Treasury bill auctions.

In addition to Treasury bill auctions, an issuance window may open during the second quarter of the year. The timing of the Treasury bill issuance is subject to the liquidity position and refinancing needs of the central government. Treasury bills are issued in euros and US dollars.

The next Quarterly Review will be published on 28 June 2024.

Further information: Deputy Director Anu Sammallahti, tel. +358 295 50 2575, or Senior Manager Mika Tasa at Treasury Front Office, tel. +358 295 50 2552, firstname.surname(at)statetreasury.fi