The Republic of Finland raised EUR 3 billion with a new benchmark bond maturing on 15 April 2045. The bond was priced at 75 bps over the euro swap curve.

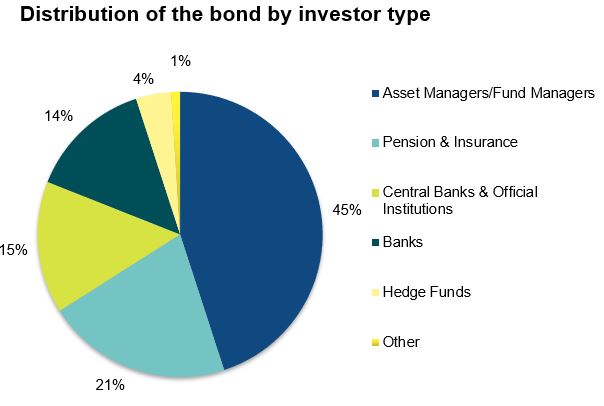

The bond attracted a record demand with an order book in excess of EUR 31 billion from more than 220 investors. This is the largest book ever, with the number of investors participating the highest ever, for Finland’s syndicated transactions.

Similar records have been made in the syndicated deals of other eurozone countries this January. According to Deputy Director Jussi Tuulisaari, the strong demand for the new Finnish bond was therefore not entirely unexpected.

“Demand is often stronger at the start of the year. Other possible explanations could include the market expectations for interest rate cuts, and the relatively attractive levels of eurozone government bond yields compared to, for example, the euro swap rates,” Tuulisaari says.

The issue was lead-managed by Barclays, BofA Securities, Danske Bank, Deutsche Bank and J.P. Morgan. The other primary dealers were also included in the syndicate group.

Emission details:

Issue amount: EUR 3 billion

Pricing date: 22 January 2025

Payment date: 29 January 2025

Maturity: 15 April 2045

Coupon: 3.200%

Price: 99.935

Yield: 3.205%

ISIN Code: FI4000586284

Further information: Deputy Director Jussi Tuulisaari, tel. +358 295 50 3819, firstname.lastname(at)statetreasury.fi