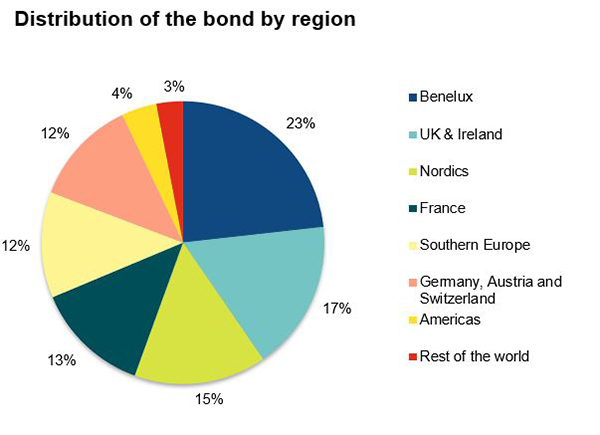

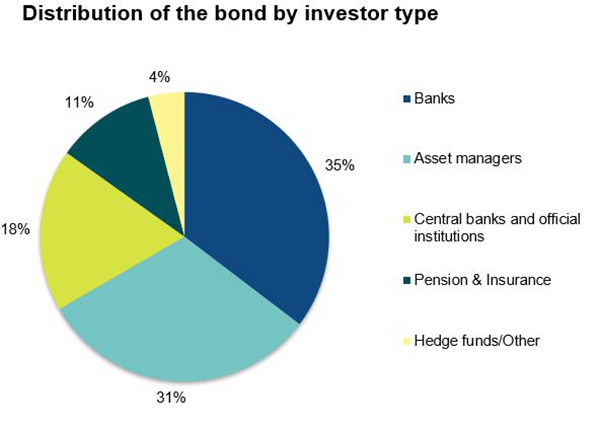

The Republic of Finland raised EUR 4 billion with a new benchmark bond maturing on 15 September 2034. The bond attracted an order book of EUR 23 billion from over 160 investors.

The bond was priced at 20 bps over the euro swap curve. The order book was multiple of issue size, signaling strong demand for the new benchmark.

“The total number of investors participating in the deal was also very high. Our 10-year bonds have not offered this kind of a pick-up vs. asset swaps for a long time, which may have attracted bank treasuries in particular”, Deputy Director Anu Sammallahti said.

Given the oversubscription, the timing turned out to be good, too. “This is probably testament either to the maturity or timing within the interest rate cycle that was a good match to investor preferences”, Sammallahti said.

The issue was lead-managed by Citi, Crédit Agricole CIB, J.P. Morgan, Nomura and Nordea. The other primary dealers were also included in the syndicate group.

Details:

Issue amount: EUR 4 billion

Pricing date: 23 April 2024

Payment date: 30 April 2024

Maturity: 15 September 2034

Coupon: 3.000%

Price: 99.870

Yield: 3.016%

ISIN Code: FI4000571104

Further information: Deputy Director Anu Sammallahti, tel. +358 295 50 2575, firstname.lastname(at)statetreasury.fi