You can find answers to these questions on this page:

What is central government debt?

Who decides on central government borrowing?

Why is the central government borrowing money?

What is the disadvantage of central government’s indebtedness?

How much debt has Government of Finland accumulated?

In which currency is Finland’s central government debt?

What is the difference between net borrowing and gross borrowing?

What is the difference between on-budget debt, central government debt and general government debt?

Who are Finland’s creditors?

How does the government pay interest on its bonds when the owner of the bonds is not known?

Now that interest rates have risen, could the government not borrow from its own citizens?

Do you have a question that was not on the list? Send it to us using the “Did you find what you were looking for?” function on the left, or by emailing us on rahoitus(at)valtiokonttori.fi

Central government debt has been accumulated over past decades

When a central government’s expenditure exceeds its revenue, it becomes indebted. Parliament decides on the borrowing needs and the amounts to be borrowed in the budget each year. In other words, central government debt is the cumulative amount of expenditure that has exceeded revenue over past decades.

By borrowing money, a central government can make long-term investments and has more room for manoeuvre in its fiscal policy in different economic cycles. The amount of central government debt thus reflects the government’s fiscal policy as well as economic growth trends. Government indebtedness may also stem from external shocks or economic crises impacting the economy.

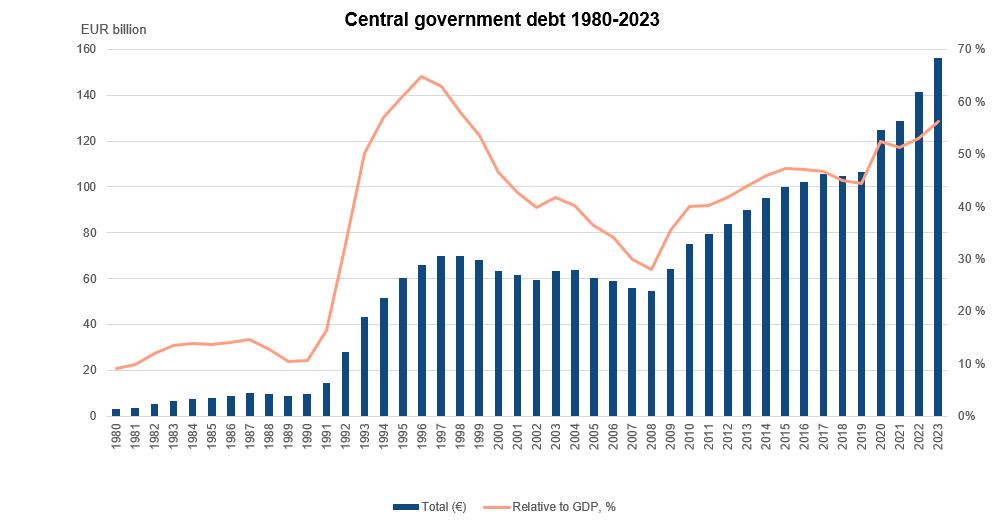

The amount of central government debt should be examined in relation to the size of the national economy. This is often done by using the debt-to-GDP ratio. At the end of 2024, Finland’s central government debt amounted to 61.2% of its GDP (estimate).

Republic of Finland has borrowed money since the 19th century

By borrowing money, Finland has financed investments in sectors such as infrastructure and gained more room for manoeuvre in fiscal policy. Wars, economic crises and demographic trends have also impacted Finland’s debt levels.

The time series below, which starts from 1980, shows that there have been three periods of rapid growth in Finland’s central government debt in the recent decades: during the recession of the 1990s, in early stages of the financial crisis (2009) and during the COVID-19 crisis (2020).

Read more about the history of Finnish government borrowing.

For a longer time series of Finland’s government debt and GDP growth trends, starting from 1940, please go to our Statistics page.

Parliament decides on central government borrowing

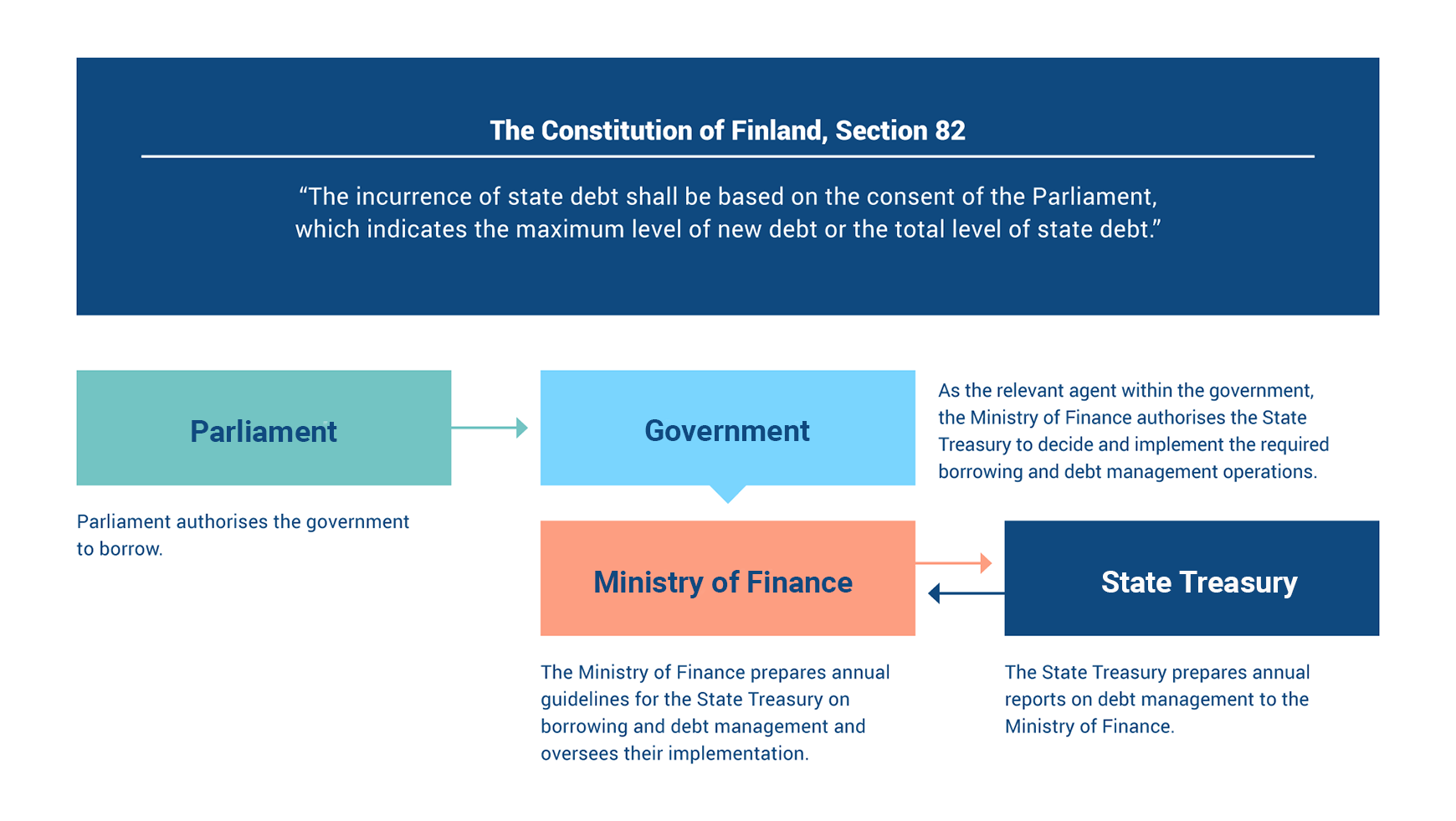

Authorisation for central government borrowing is granted by Parliament. The Ministry of Finance has authorised the State Treasury to implement the central government borrowing in accordance with the authorisation granted by Parliament.

Parliament sets the upper limit for long-term and short-term government debt. At present, the nominal value of Finland’s central government debt may not exceed EUR 205 billion and short-term debt (of less than 12 months) may not total more than EUR 35 billion.

Parliament approves the amount of new net borrowing in the budget each year. The strategy for central government debt management is set by the Ministry of Finance. The State Treasury carries out its debt management tasks in accordance with the guidelines issued by the Ministry of Finance.

Why is the central government borrowing money? What is meant by central government borrowing?

A central government borrows money to repay maturing government debts and to cover it budget deficit (the difference between revenue and expenditure).

The aim of borrowing is to meet the central government’s financing needs cost effectively and in a manner that ensures access to financing under all circumstances. At the same time, it is ensured that the burden on government finances caused by interest expenses and redemptions of central government debt is distributed evenly and in a foreseeable manner. The risks arising from borrowing are kept at a low level.

What is the disadvantage of central government’s indebtedness?

Central government indebtedness matters because the government has to pay interest expenses on its debt. For example, in 2024, the central government will take on more than EUR 10 billion of additional debt to cover the budget. Interest expenses on central government debt in 2024 were roughly EUR 3 billion.

Government indebtedness is about the ability of the government to pay interest costs and ultimately creditworthiness. If the government does not manage its finances responsibly, the financiers will be more careful to lend more money in the future, which means that the terms of the debt will become worse and the debt more expensive. The government cannot incur unlimited indebtedness without an increase in the costs of the debt or a deterioration in its availability. In other words, the more responsible central government borrowing is in relation to central government solvency, the more likely it is that borrowing can continue at reasonable costs.

How much debt has the Government of Finland accumulated?

The State Treasury publishes statistics on central government debt each month. For the latest figures, go to our Statistics page.

You can also receive the latest updates on the government debt statistics by email.

In which currency/currencies is Finland’s government debt?

Finland’s total central government debt is denominated in euros.

The government does not take any exchange rate risk in its borrowing, but instead eliminates the exchange rate risk with derivative contracts. After hedging measures, the entire central government debt is denominated in euros.

What is the difference between net borrowing and gross borrowing?

Central government net borrowing shows how much central government debt changes over the period of one year (how much new debt the Republic of Finland issues or how much existing debt it repays). Net borrowing is denominated in euros and it represents central government surplus/deficit – the difference between revenue and expenditure – which can be adjusted in supplementary budgets during the year.

In addition to net borrowing, the Republic of Finland also takes out new loans to replace maturing loans. Central government gross borrowing is the sum of these two phenomena (change in the amount of debt and the debt maturing during the year).

What’s the difference between on-budget debt, central government debt and general government debt?

On-budget entities are the part of the central government finances comprising the revenue and expenditure that are included in the budget. The term has the same meaning as on-budget finances and the debt generated by on-budget entities is debt generated by on-budget finances.

On-budget entities comprise the Finnish Parliament, Office of the President of the Republic and Finland’s 12 ministries as well as the government agencies operating under the ministries.

The central government finances cover the activities of on-budget entities, off-budget funds and unincorporated state enterprises. Thus, central government debt is debt generated by on-budget entities, off-budget funds and unincorporated state enterprises.

The Republic of Finland has eleven off-budget funds and two unincorporated state enterprises.

General government debt is a wider concept. General government debt is debt owed by general government. General government comprises central government, municipalities, joint municipal authorities, the Provincial Government of Åland, statutory pension insurance companies and institutions, other social security funds and employment pension funds.

At the end of 2024, Finland’s central government debt-to-GDP ratio stood at 61.2%. At the end of 2024, Finland’s general government debt-to-GDP ratio stood at 82.5%.*

* In June 2022, Statistics Finland made an exceptional revision to the financial accounts statistics that significantly affects general government consolidated EDP debt and increases the debt ratio of general government, i.e. the GDP share of the debt. The debt ratio calculated according to the new method is 5.9 percentage points higher than that calculated according to the old method in 2021. The revision is explained in details in the Statistics Finland website.

Who are Finland’s creditors?

The Republic of Finland aims to ensure a geographically diversified investor base for its borrowing. The diversification is part of the management of the long-term refinancing risk.

State Treasury knows the composition of the order book for its new loans but is not provided with any information about the changes in ownership of the loans in the secondary market. Indicative information on Finland’s creditors or the share of central government debt held by domestic investors can be obtained by examining the distribution of investors in the order books of new loans issued by the Republic of Finland.

Banks, central banks, funds, insurance and pension companies are typical investors in sovereign debt. Sovereign bonds and other funding instruments, such as Treasury bills, are intended for institutional investors. The Republic of Finland does not currently issue products intended for retail investors. However, many of the investment funds open to retail investors also invest in sovereign loans.

How does the government pay interest on loans when the owner of government loans is not known?

The State Treasury pays the outstanding principal or coupon interest to the CSD through which the issue is made. A CSD then distributes the amount on the basis of its books to account managers, i.e. banks whose clients own the security. Finally, the account managers ensure that the money ends up in the investor’s account.

The CSD’s information on the holders of a bond is called a list of creditors. Contrary to the shareholders’ list, the list of creditors is not publicly available and therefore the debtor does not have access to the information on this list.

Could the government borrow from its own citizens? Is the State Treasury planning retail bonds for citizens, as there were before?

The State Treasury has indeed previously issued yield bonds that were intended for private individuals. The last issue was in the early 2010s.

Since then, this form of loan has been abandoned, partly due to weak demand resulting from low interest rates, but especially because loans realised in small instalments are inefficient fund-raising for the government. The State Treasury’s task is to cover the central government’s funding needs as cost-effectively as possible (taking risks into account), and benchmark-based funding in the wholesale market enables multi-billion-dollar funding at a time. There are currently no yield bonds planned.