The strategic goal of debt management is to cover the central government’s financing needs and minimise the long-term costs of debt with measures that adhere to an acceptable level of risk.

Framework of government borrowing

The strategy for central government debt management is set by the Ministry of Finance. The State Treasury carries out its debt management tasks in accordance with the Ministry’s instructions.

The Ministry’s guidelines set out the general principles and objectives of debt management, the instruments and risk level, as well as any other applicable restrictions. The State Treasury is authorised to raise funds provided that the nominal value of the central government debt does not exceed EUR 205 billion. Of this amount, up to EUR 35 billion may by short-term debt.

The State Treasury is authorised to take out short-term loans when necessary to safeguard the central government’s liquidity and, as part of its risk management, to enter into derivative agreements that comply with the terms and instructions issued by the Ministry of Finance.

The State Treasury reports regularly to the Ministry of Finance on its debt management. Key information on the central government’s debt management is also published annually in the central government’s financial statements and the Government’s annual report. The central government’s financial statements are published every year in March and the Government’s annual report in May.

The infograph shows the legal framework and the division of functions of government borrowing between the Parliament, the Government, the Ministry of Finance, and the State Treasury.

Risk management: an essential part of sound debt management

The goal of risk management is to avoid unexpected losses and safeguard the continuation of operations. The aim of central government is to manage all risks in a systematic manner. Its risk management process consists of identification of risks, quantifation and evaluation of risks, risk monitoring and reporting, and active management of its risk positions.

The main risks are financing risk (long-term refinancing risk and short-term liquidity risk), market risk (interest and exchange rate risk), credit risk, operational risk, and legal risk.

Financing risk

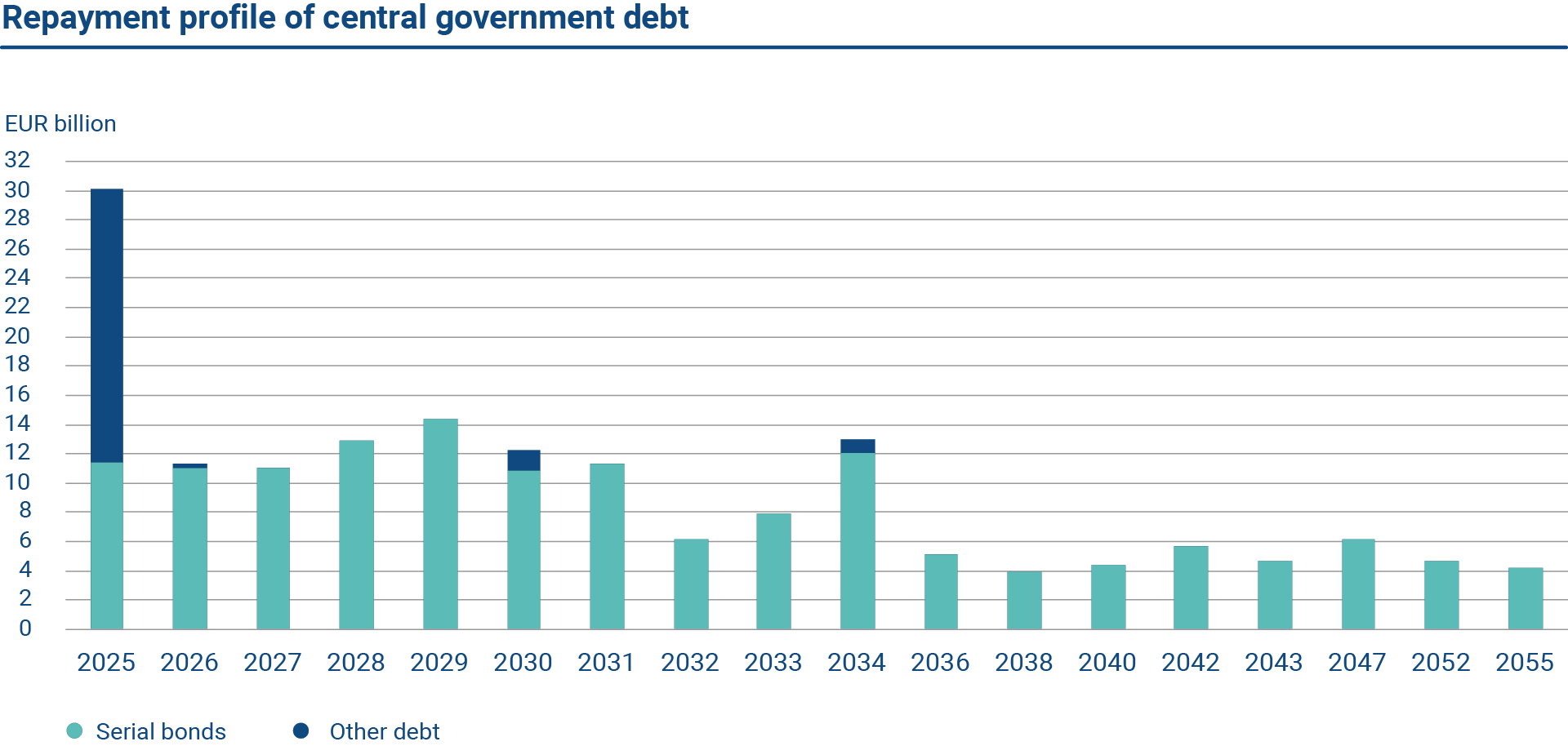

Financing risk can be divided into refinancing risk and liquidity risk. The former is generally measured by the amount of required refinancing, for example, over the course of a year. However, financing risks are also affected by other factors, especially the need to ensure adequate and diverse sources of funding. The latter refers to the risk associated with the central government short-term financing needs compared to its liquid cash funds and funding capability.

The State Treasury manages refinancing risk first and foremost by avoiding large maturity concentrations of debt subject to limits set by the Ministry of Finance. Refinancing risk can also be alleviated by diversifying funding in different instruments, investor types and geographic areas. This reduces the risk associated with an individual source of funding and improves the liquidity and attractiveness of government bonds to investors.

The State Treasury manages liquidity risk by keeping a sufficient cash buffer. This buffer will be larger if uncertainty related to the availability of funding is perceived to rise. The debt management guidelines include a minimum target time (of 30 days) for how long the central government must be able to cover its current and expected expenditures without new borrowing.

Liquidity risk management is based on the central government cash flow forecast system. In practice, the cash reserves are primarily invested in the Bank of Finland. Cash reserves can also be invested in other collateralised or low-risk short-term maturities.

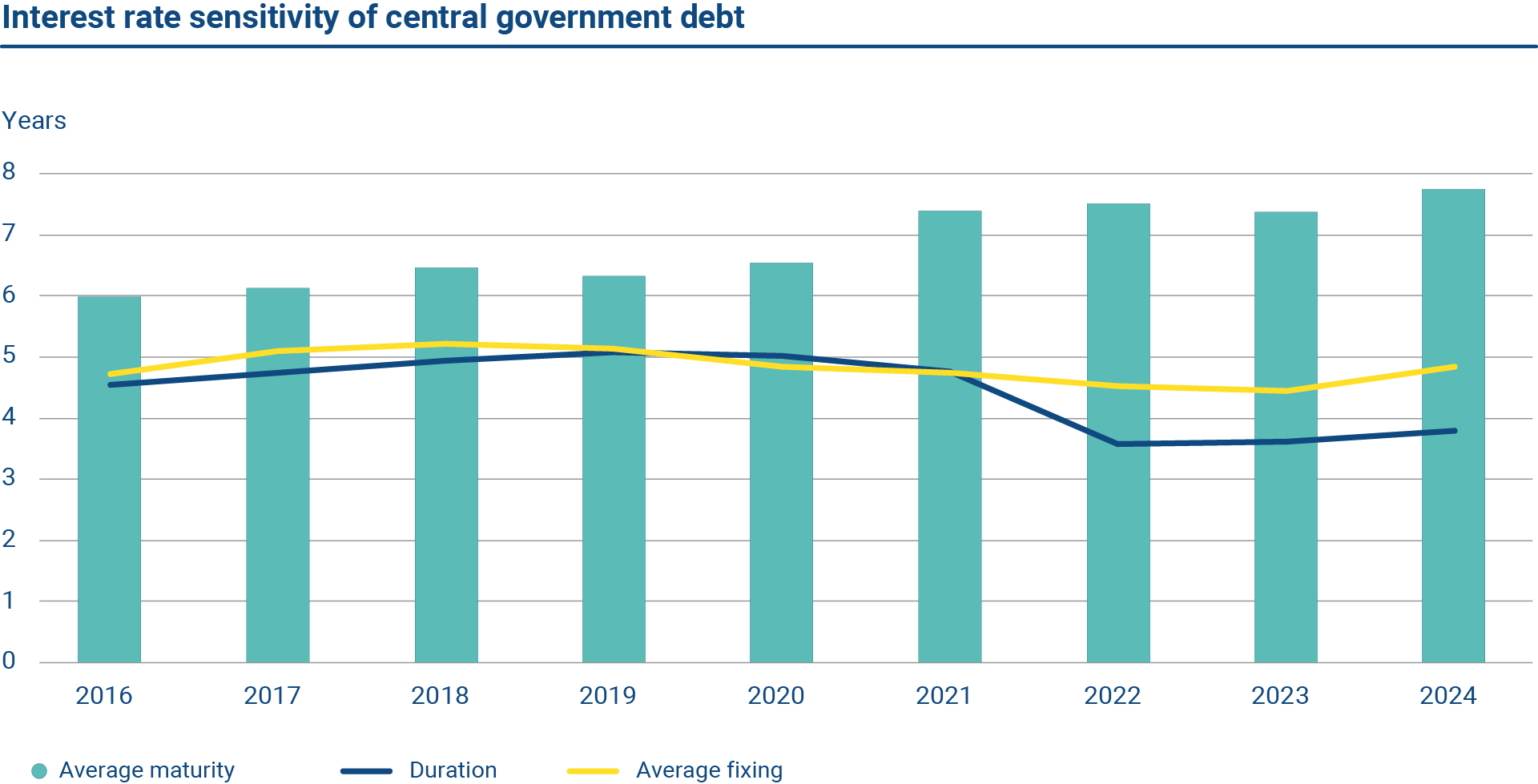

Market risks

A new target variable for the interest rate risk management of the central government debt is the weighted average maturity at issuance (WAMI). The target for WAMI is a weighted average of seven years in the medium term starting from the year in which the new guidelines went into force. The weighted average maturity for the medium-term period can deviate by up to six months from the aforementioned average maturity target. For short-term borrowing, the calculation applies to the year-end debt stock and the average maturity of short-term issuance during the year. The weighted average maturity for borrowing in 2024 was 7.70 years.

The central government takes no exchange rate risk in debt management operations. There was no exchange rate risk relating to the outstanding debt at the end of 2024.

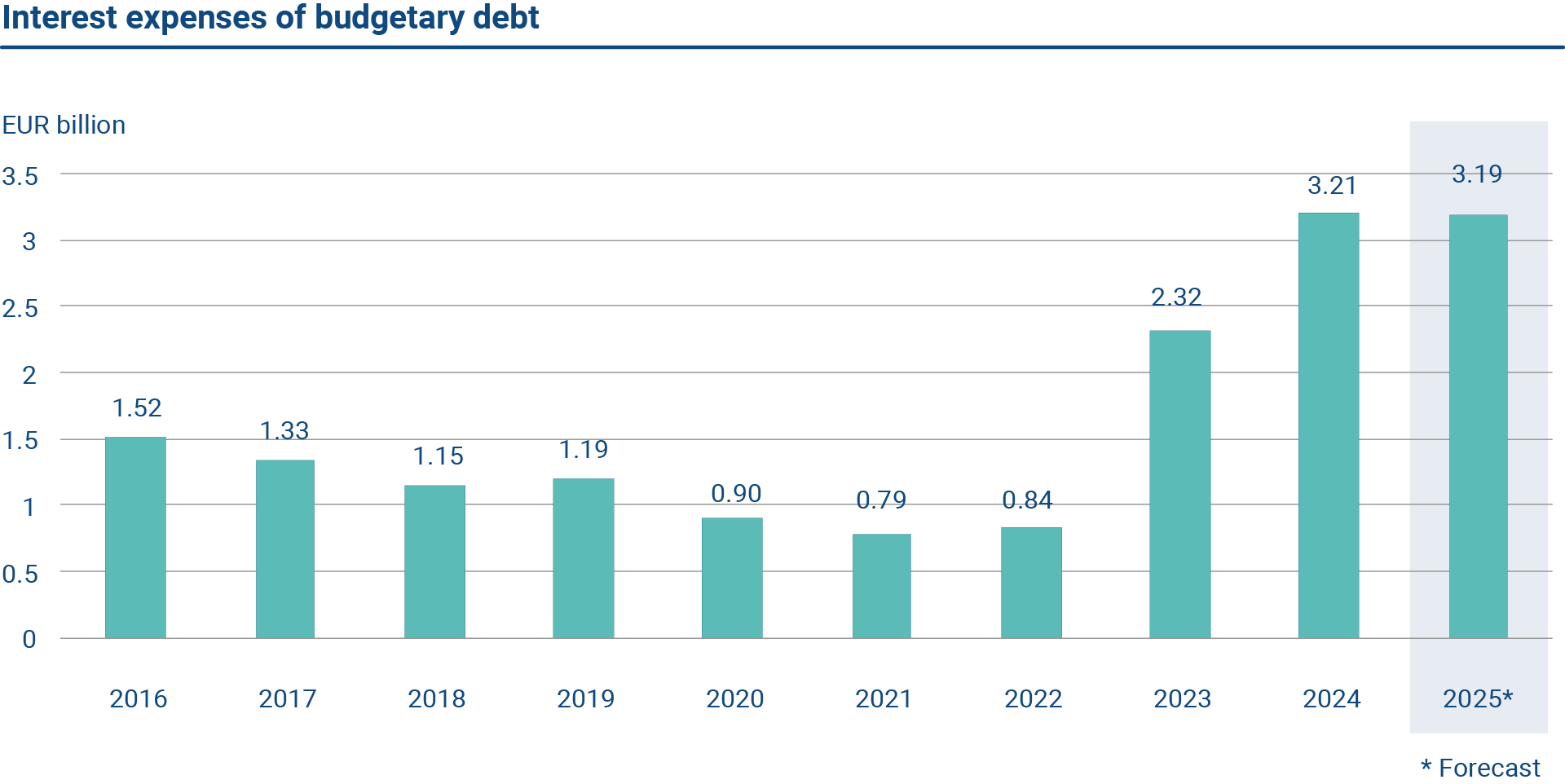

The graph shows the annual interest expenses of budgetary debt in 2016–2025. In 2024 the interest expenses were EUR 3.21 billion. The forecast for 2025 is EUR 3.19 billion.

The graph shows the key figures on the interest rate sensitivity of central government debt. At the end of 2024, the average fixing of the central government debt was 4.84 years and duration 3.79 years. The average maturity was 7.75 years.

Credit risk

Credit risk arises from the investment of cash assets and derivative agreements. The state requires its counterparties to have a high level creditworthiness, and the Ministry of Finance’s guidelines set limits and minimum thresholds for the credit ratings of counterparties. Credit risk management is particularly critical in large cash investments. To reduce the credit risk associated with cash investments, the State Treasury primarily invests cash assets in the Bank of Finland and additionally in, for example, secured tripartite repo agreements.

The State Treasury uses collateral to reduce the long-term credit risk arising from from derivatives. Like many other states, Finland uses a collateral agreement (CSA, Credit Support Annex) under the ISDA framework agreement. A bilateral collateral agreement means that both parties are obligated to provide collateral against derivative positions.

Operational risk

Operational risk means a risk arising from external factors, technology, or the inadequate performance of personnel, organisation or processes. A field requiring special attention is data security, which encompasses the security of both documents and IT systems. Equal focus is given to developing and continuously testing operative business continuity plans. Regular audits by external cybersecurity experts have also spurred improvements in operative processes.

The principles of operational risk management are implemented in daily operations. Incidences of realised risk events and near-miss incidents are compiled and reported to management. The State Treasury monitors risk factors and events regularly and makes risk assessments.

Legal risk

Legal risk is the risk resulting from failure to comply with laws and regulations or established market practices as well as invalidity, nullity, voidability, discontinuation or the lack of documentation of contracts, agreements and decisions.

The State Treasury has prepared a set of internal guidelines for the management of legal risks. The State Treasury actively monitors its legal operating environment and reacts to significant changes quickly when necessary.

The objectives of legal risk management are to ensure compliance with all applicable laws, rules and regulations and to minimize legal risk by utilising standard agreements and the government’s own templates. In addition, steps are taken to ensure that employees are familiar with legislation, regulations and market practices concerning their activities.

Internal Control

Internal control is an integral part of management of the State Treasury. Internal control ensures the quality and efficiency of operational processes, the reliability of internal and external reporting, and compliance with laws and regulations. A sound system of internal control helps all parts of the organisation to reach their targets.

As part of internal control all main debt management processes are evaluated on an annual basis. The assessment pays special attention to the clarity of the State Treasury’s objectives, risks, and control procedures.