The year 2024 was a challenging one for the Finnish economy as gross domestic product (GDP) stayed more or less still. Output was most adversely affected by the significant reduction in construction. On the other hand, Finland’s exports increased despite the challenging international environment. In 2025 the GDP is expected to return to clear growth.

Finland’s exports recovered in 2024, driven particularly by the strong growth in services sold to Asia and Europe. Conversely, the contraction in goods trade within the Eurozone has continued, explaining the subdued performance of Finnish goods exports. Finland’s current account was close to a balance in 2024.

Inflation slowed down significantly in 2024 compared to the previous year. The average inflation rate was 1.6% in 2024. Price pressures were kept in check despite the increase in the standard VAT rate. Inflation is expected to remain moderate in the coming years. The slowdown in inflation contributed to the increase in real household disposable income in 2024. However, private consumption did not rise as household saving increased significantly.

Consumer confidence was particularly dampened by the rise in unemployment. The unemployment rate is estimated to have risen to 8.3% in 2024. Job vacancies decreased, and employment weakened especially in industry and construction. In 2025, the labour market is expected to recover, but the decline in unemployment is likely to be slow. Finland’s employment rate remained relatively high at 76.6% despite the increase in unemployment in 2024.

Investment is estimated to have decreased in 2024 but a clear turn for the better is expected for 2025, boosted by the falling interest rates. In construction, the bottom has likely been surpassed though the volume of granted building permits is still low. Along with the recovery in construction, machine and equipment investment is expected to turn into growth.

Public Finances

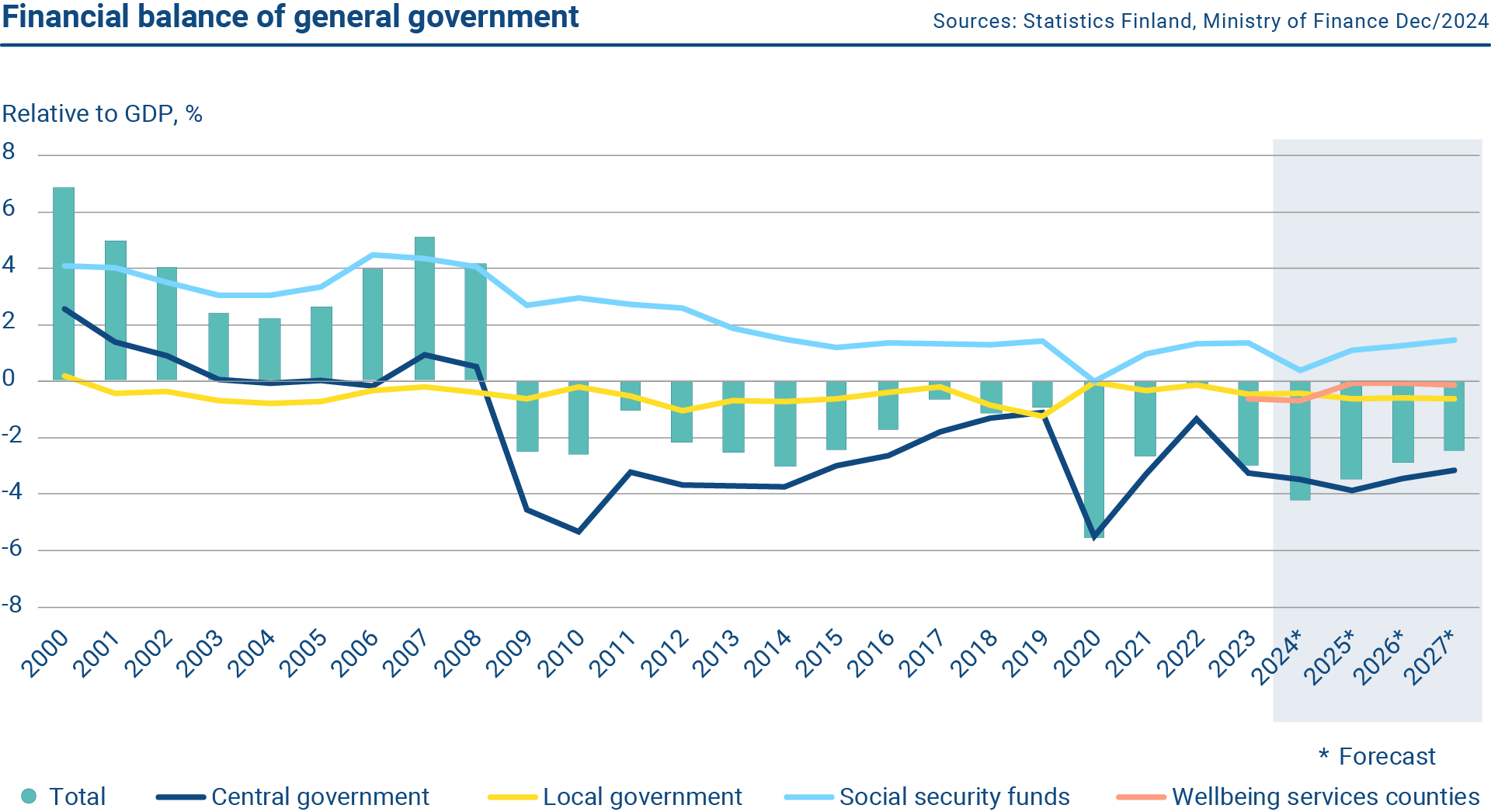

The year 2024 was difficult for Finland’s public finances. The general government financial deficit is estimated to have been 4.2% relative to GDP, while the general government debt ratio now exceeds 82%. The growing debt levels were driven by weak economic conditions, an increase in contingency expenditure and the lingering effects of rapid inflation in previous years. In 2025, the deficit is expected to improve to 3.5%. Defence spending will increase expenses, but the fiscal consolidation measures decided by the Government will significantly reduce expenditure and increase revenue.

Among the subsectors of Finland’s general government, the central government remains most in deficit. Central government’s spending pressures have come from national defence and border security requirements and higher interest expenditure, among other factors. The local government as well as the wellbeing services counties were also in deficit in 2024, however, the general government finances are balanced by the surplus in the social security funds.

The graph shows the financial balance of the Finnish general government. Social security funds are running a surplus while central and local government show deficits.

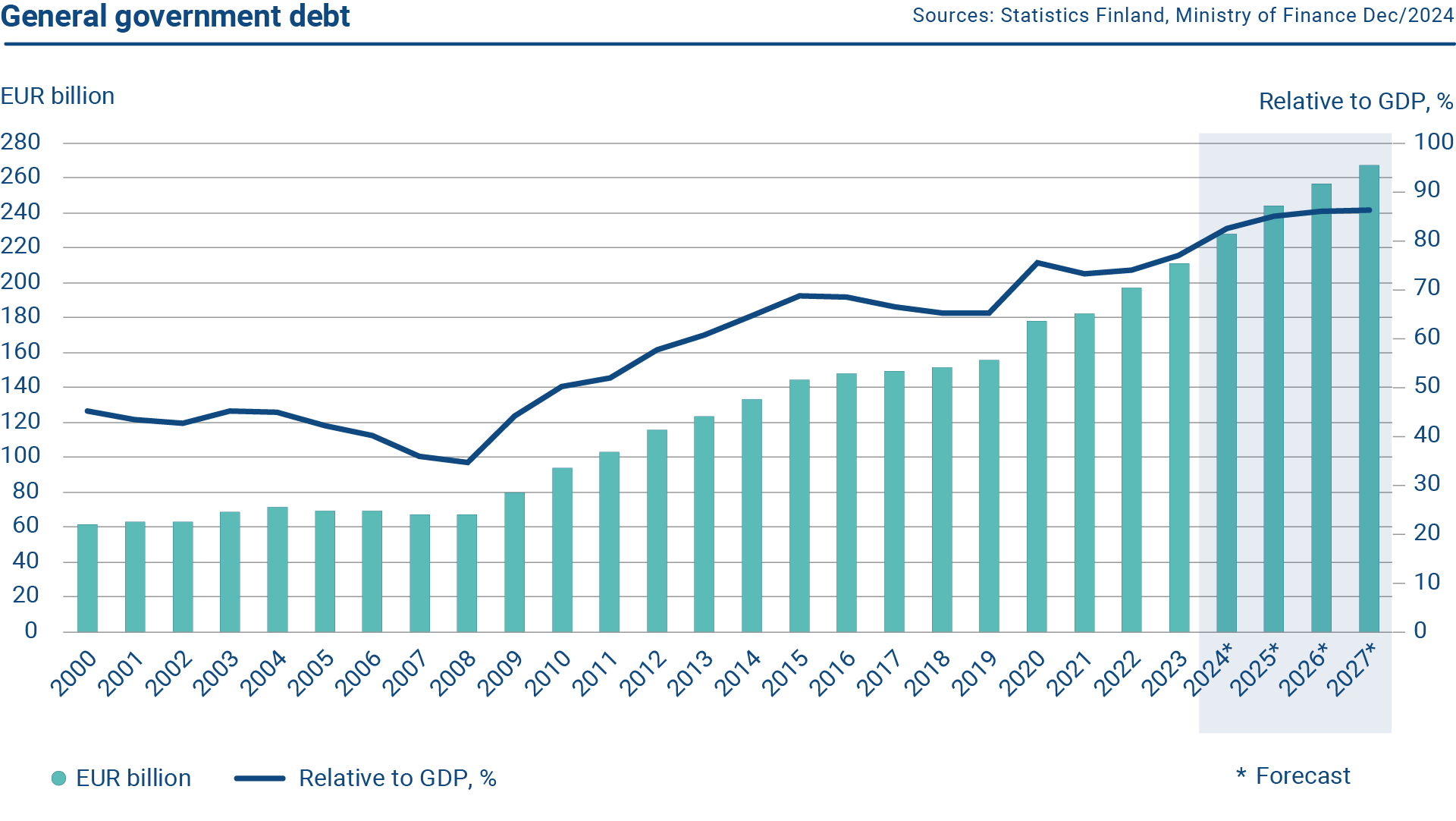

Finland’s general government debt stood at 82.5% relative to GDP at the end of 2024. The debt ratio increased by 5.4 percentage points from the previous year. Despite extensive fiscal consolidation, the debt ratio will first continue to rise but more slowly, after which it is foreseen to stabilise by the end of the decade. At the end of 2024, the estimate for the central government debt is 61.2% relative to GDP, while the central government deficit is estimated at 3.5% relative to GDP. The central government debt-to-GDP ratio increased by more than four percentage points from the previous year.

The graph shows the volume of Finland’s general government debt. In 2024, the general government debt was EUR 227.9 billion. The debt-to-GDP ratio was 82.5%.

The Republic of Finland has solicited credit ratings from Fitch Ratings (AA+ / negative outlook) and Moody’s Ratings (Aa1 / stable outlook). In addition to these solicited ratings, the Republic of Finland has several unsolicited credit ratings.

Interest rate developments

The continued slowdown in inflation in 2024 led the US Federal Reserve (FED) and the European Central Bank (ECB) to start lowering interest rates. The ECB cut the deposit rate three times in June, September, and December from 4% to 3.25%. Similarly, the FED cut rates in September, November, and December by a total of one percentage point. The ECB has ended its monetary policy purchasing programmes and related reinvestments, the latest of which (under the Pandemic Emergency Purchasing Programme, PEPP) were discontinued at the end of 2024.

The interest rates on Finnish government bonds rose in the first half of the year and similarly fell in the second, except in December, when rates turned upward again. The yield on the 10-year benchmark bond rose from the opening level of 2.66% to 2.74% at year end. In the secondary market, the 10-year RFGB benchmark bond has yielded on average 2.85% in 2024.

The graph shows the 10-year government bond yields of Germany, Finland and the United States in 2016-2024.

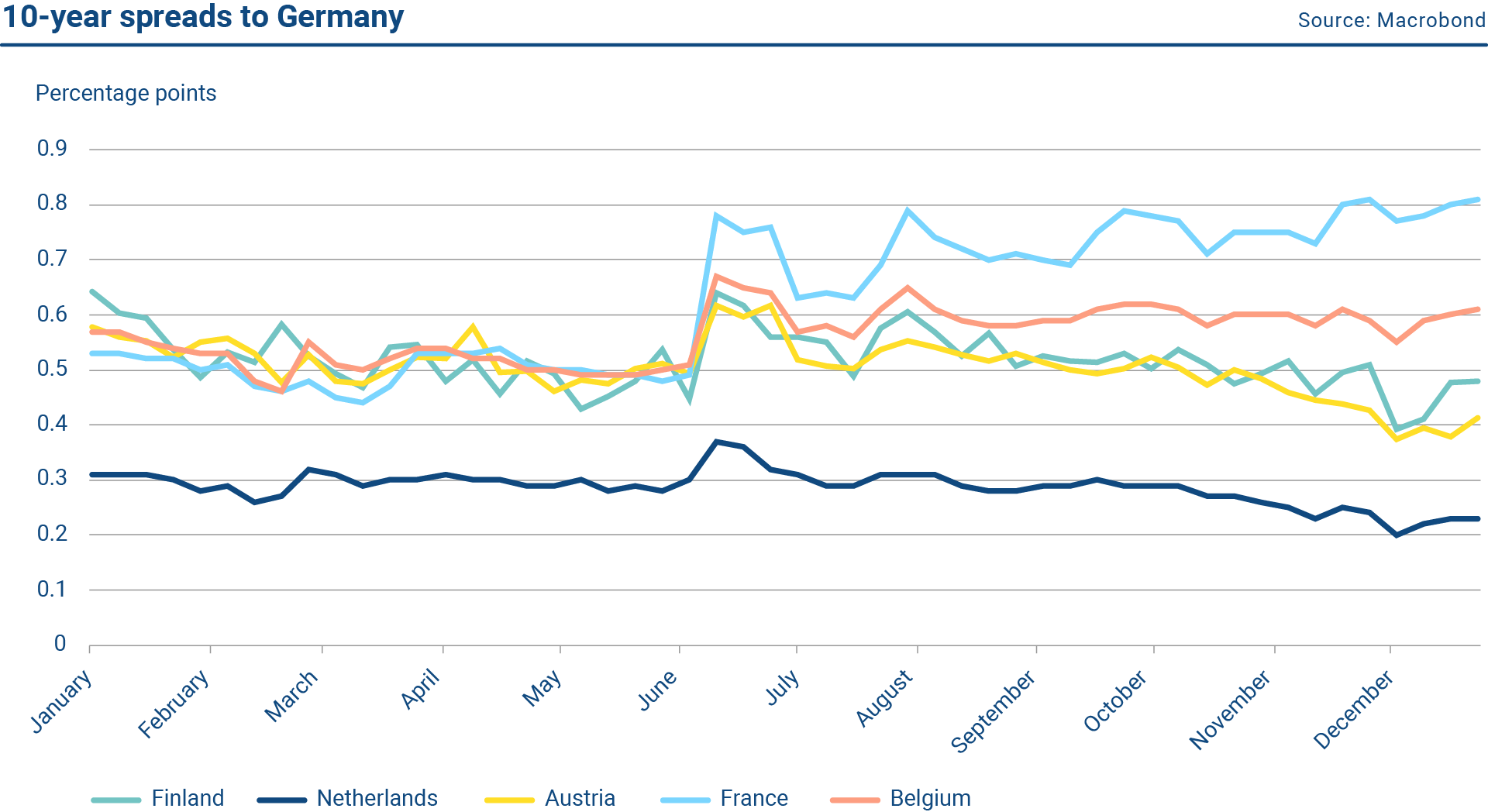

The yields on Finnish and German government bonds remained fairly stable during the year. In the US, the government bond yields rose towards the end of the year. This was influenced by Donald Trump‘s re-election to office in November 2024 and the consequent rise in inflation expectations, which in turn reduced the expectations for rate cuts. Following the end of the ECB’s asset purchasing programmes and given the large borrowing needs of euro area countries, the supply of government bonds increased, which significantly widened the yield spreads relative to swaps during 2024. The yield spread of Finland’s 10-year benchmark bond to Germany was somewhat stable in 2024, narrowing towards the end of the year. A similar movement relative to Germany was seen in the yield spreads of peer sovereigns like the Netherlands and Austria.

The graph shows the 10-year bond spreads of Finland, the Netherlands, Austria, France and Belgium against Germany.

Secondary market trading

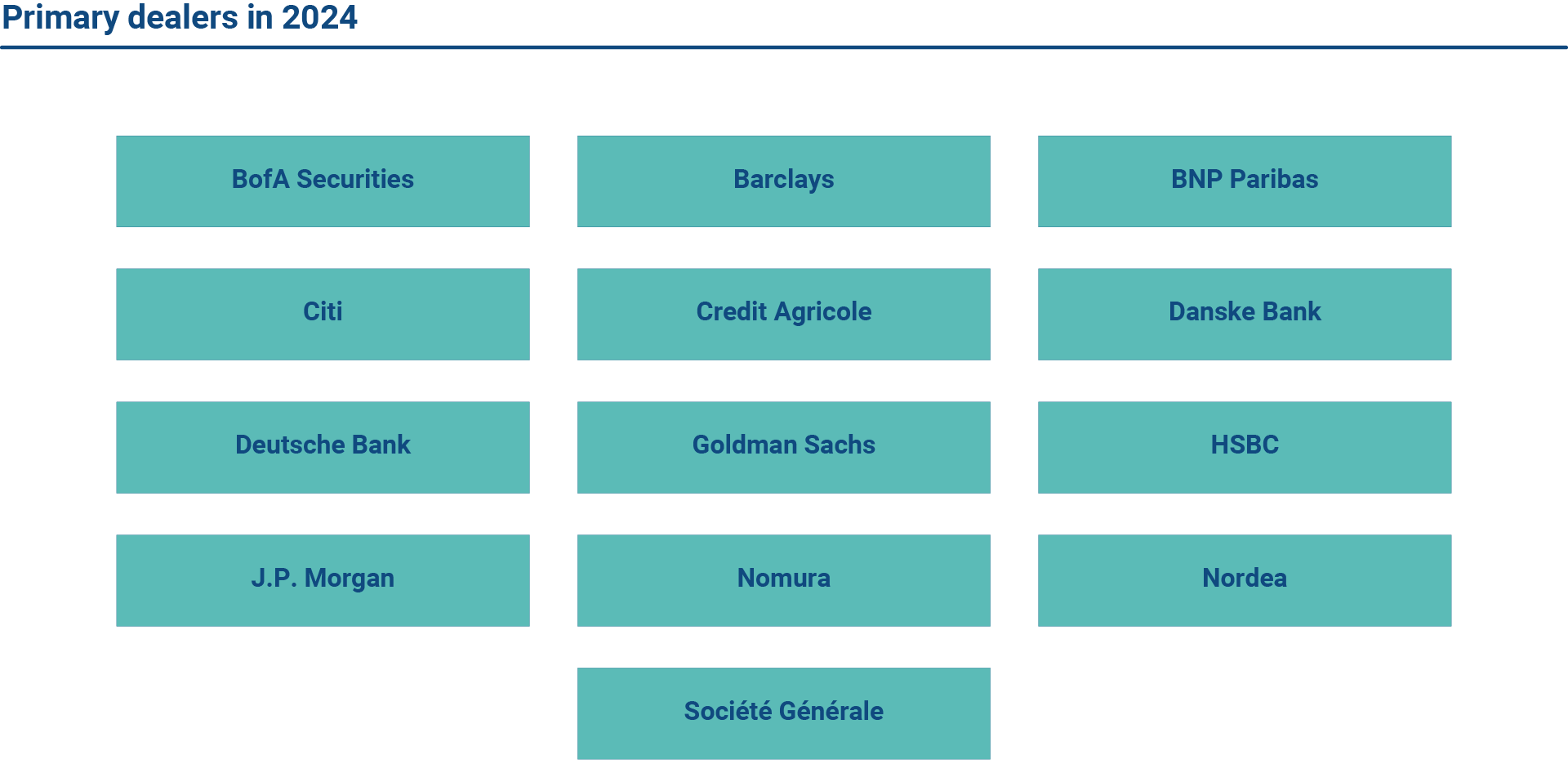

It is a priority for the State Treasury to work actively with the Primary Dealers to maintain and further enhance the liquidity of the Finnish government bonds. Primary Dealers report customer trade volumes to the State Treasury within the Harmonized Reporting Format as agreed by the EFC Sub-Committee on EU Sovereign Debt Markets.1 The reporting takes place on a monthly basis, and the data is consolidated and used for monitoring and analysis.

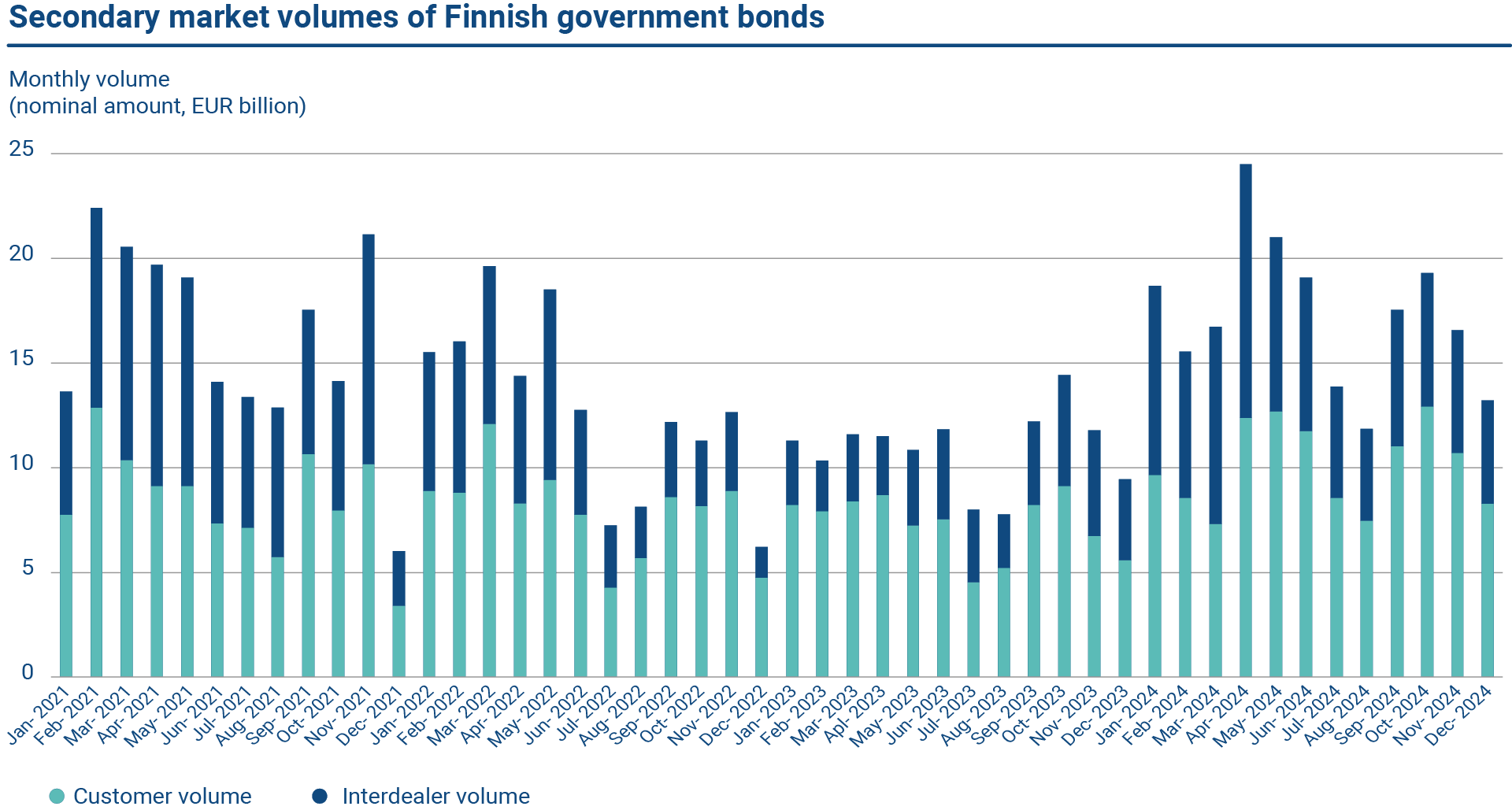

According to HRF data, the overall secondary market customer turnover volume increased in comparison to 2023. The annual turnover in total was EUR 121.3 billion (EUR 87.6 billion in 2023). The average monthly turnover volume (sales and purchases) was EUR 10.1 billion in 2024 (EUR 7.3 billion in 2023). In relative terms, the monthly average turnover volume was 7.0% of the total outstanding euro benchmark bond stock (5.6% in 2023).

Finnish government benchmark bonds can be traded on the MTS Finland and ICAP BrokerTec interdealer platforms. The State Treasury does not participate in secondary market activity, and the interdealer trading is based on the activity of the Primary Dealers and other market participants. In 2024, the nominal interdealer trading volume (turnover, i.e., sales plus purchases) was on average EUR 7.2 billion per month (EUR 3.6 billion in 2023).

The graph shows the secondary market volumes of Finnish government bonds in 2021-2024. In 2024, the nominal interdealer trading volume was on average EUR 7.2 billion per month. The average monthly customer volume was EUR 10.1 billion.

The State Treasury actively follows the Primary Dealer quoting activity in the secondary markets. There are guidelines for the Primary Dealers on quoting for different maturities in the interdealer market, where the bid-offer spread of the price quotes is observed and tracked. The average bid-offer spread of all the market makers is calculated and each Primary Dealer benchmarked against the average. On a weekly basis, the State Treasury reports the analysed spread data for the benchmark bond quotes back to the individual Primary Dealer banks. The secondary market liquidity for RFGBs improved in 2024 in terms of tighter bid-offer spreads compared to the previous year.

1 Using Harmonized Reporting Format, the national data on secondary market turnover from each euro area country is then aggregated into Euro Market Activity Report (EMAR), published by the ESDM on a quarterly basis. Further information here.