The Ministry of Finance defines the debt management strategy that the State Treasury uses to carry out its operational debt management duties. In 2024, the Ministry of Finance updated its medium-term strategy for debt management.

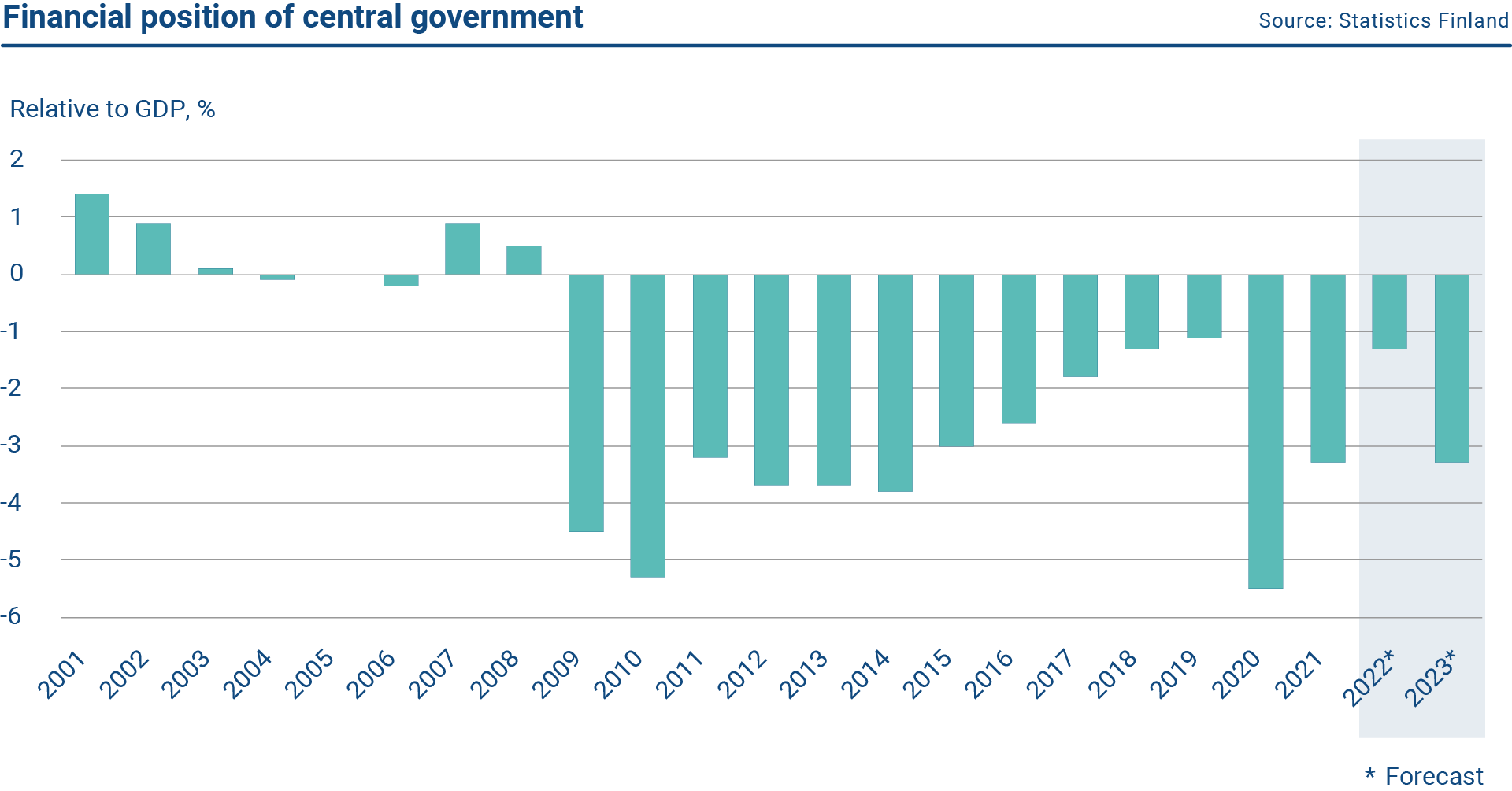

The Ministry of Finance introduced its previous debt management strategy in the early 2000s. Over the years, the ministry has reformed the central government’s debt management guidelines several times, but its key risk choices and parameters remained essentially the same. Our operating environment, however, has changed significantly since the early 2000s: the central government’s debt-to-GDP ratio has more than doubled (Figure 1), and the outlook for economic growth remains subdued due to the aging population. The central government’s finances have been in deficit for a long time (Figure 2), and its fiscal position is unlikely to change much, at least not in the near future. This means that the borrowing requirement will remain around EUR 40 billion annually. Furthermore, the regulatory environment has changed since the financial crisis, and overall economic uncertainty is high.

The graph shows the volume of Finland’s central government debt and debt in relation to GDP in 2000–2024.

The graph shows the development of central government’s financial position in Finland from 2001 to 2023, in relation to GDP.

So given that the central government’s risk-bearing capacity is weaker than before, there has been a need to reassess the risk choices made in its debt management. And for this reason, a more conservative approach to strategy was needed for a better alignment between the risk choices and the current and the foreseeable economic conditions. Our strategy update draws on recommendations of external evaluation reports. The aim of the update is to reduce the risks in debt management while also simplifying the operations.

The key change is to gradually reduce the interest rate risk associated with debt. The planned change will:

– provide protection against fluctuations in interest rates

– increase the predictability of interest expenditure

– support the planning of economic policy.

This change is likely to increase the expected interest expenditure in the long term to some extent, compared to a situation where no change would have been made.

Lengthening of the interest rate risk position will be achieved without significantly altering the central government’s established funding strategy by no longer entering into new interest rate derivative agreements. This way, the desired interest rate risk position can be gradually achieved within approximately five years.

In addition, a new target variable for new borrowing is expressed in the form of Weighted Average Maturity at Issuance (WAMI), thus combining the interest rate risk management and financing risk management. The target WAMI set in the strategy – an average calculated over the medium term – is approximately seven years. The change in the central government’s interest rate risk position will be gradual and moderate. At the end of the review period (2024-2028), the Finland’s interest rate risk position will have converged toward that of our European peers while still remaining at the shorter end of the spectrum.

The change in the central government’s interest rate risk position will be gradual and moderate.

By not entering into new interest rate derivative agreements, the potential need to provide cash collateral to counterparties will also be reduced. The change will thus reduce Finland’s current, EUR 3.5-billion collateral portfolio, as well as the potential amount of borrowing needed to finance the collateral, in the coming years. Moreover, the operational and legal risks related to derivatives and collateral movements will be diminished.

The updated strategy imposes a new minimum liquidity requirement for how long the central government must be able to cover its known expenditures without new borrowing. The new limit does not substantially alter the central government’s current liquidity position – rather, it makes the Ministry’s preferences explicit on this matter. In addition, the strategy contains certain other clarifications to the risk levels of the central government’s cash management, with the goal of strengthening its liquidity.

Our operating environment will continue to change, now and in the future. The key fiscal policy target of the Prime Minister Petteri Orpo’s government is to stabilise the general government debt-to-GDP ratio by 2027. The Government has already enacted significant fiscal consolidation measures to achieve this target. In central government’s debt management, we will review the current strategy annually and commission a more extensive, external evaluation in approximately 4-5 years’ time. These evaluations will help us revise and develop the strategy in the future as well.