The strategic objective of central government debt management is to carry out its funding requirements and minimise the financing cost over the long term – while taking account of risk.

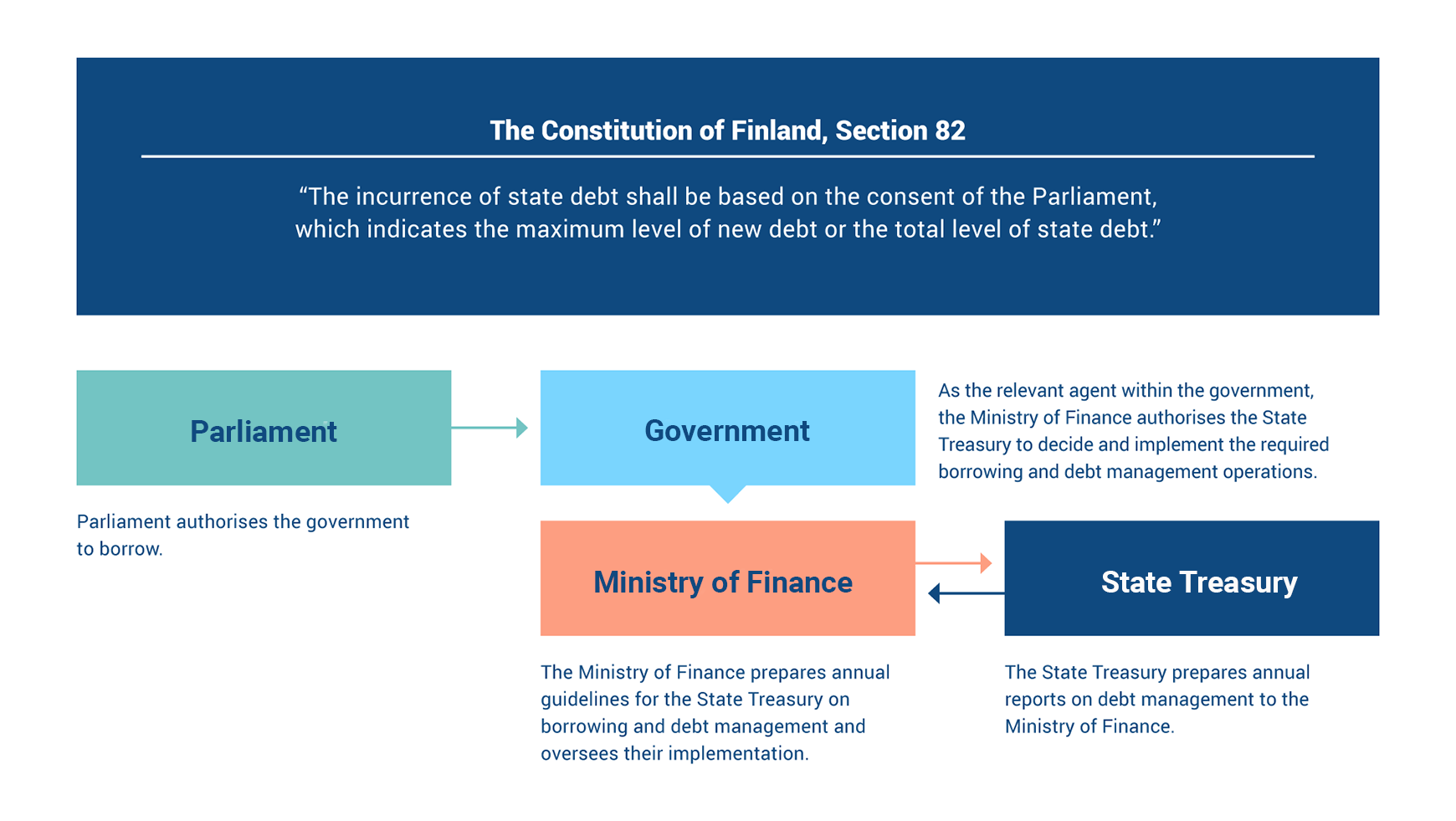

Framework of government borrowing: decided by Parliament, supervised by Ministry of Finance, implemented by State Treasury

The strategy for central government debt management is set by the Ministry of Finance. The State Treasury carries out its debt management tasks in accordance with the guidelines issued by the Ministry of Finance.

The Ministry’s guidelines set out the general principles and objectives debt management, instruments used in debt management, and risk limits as well as any other applicable restrictions. The State Treasury is authorised to raise funds, provided that the nominal value of the central government debt does not exceed EUR 170 billion. Of this amount, up to EUR 29 billion may be short-term debt.

The State Treasury is authorised to take out short-term loans when necessary to safeguard the central government’s liquidity and, as part of its risk management, to enter into derivative agreements that comply with the terms and instructions issued by the Ministry of Finance.

The State Treasury reports regularly to the Ministry of Finance on debt management. Key information on the central government’s debt management is also published annually in the central government’s financial statements and the Government’s annual report. The final central government accounts are published every year in March and the Government’s annual report in May.

Risk management: an essential part of sound debt management

The objective of risk management is to avoid unexpected losses and safeguard the continuation of operations. The aim of central government is to manage all risks in a systematic manner. The risk management process consists of identification of risks, quantification and evaluation of risks, risk monitoring and reporting, and active management of risk positions.

The main risks are financing risk (long-term refinancing risk and short-term liquidity risk), market risk (interest and exchange rate risk), credit risk, operational risk, and legal risk.

Financing risk

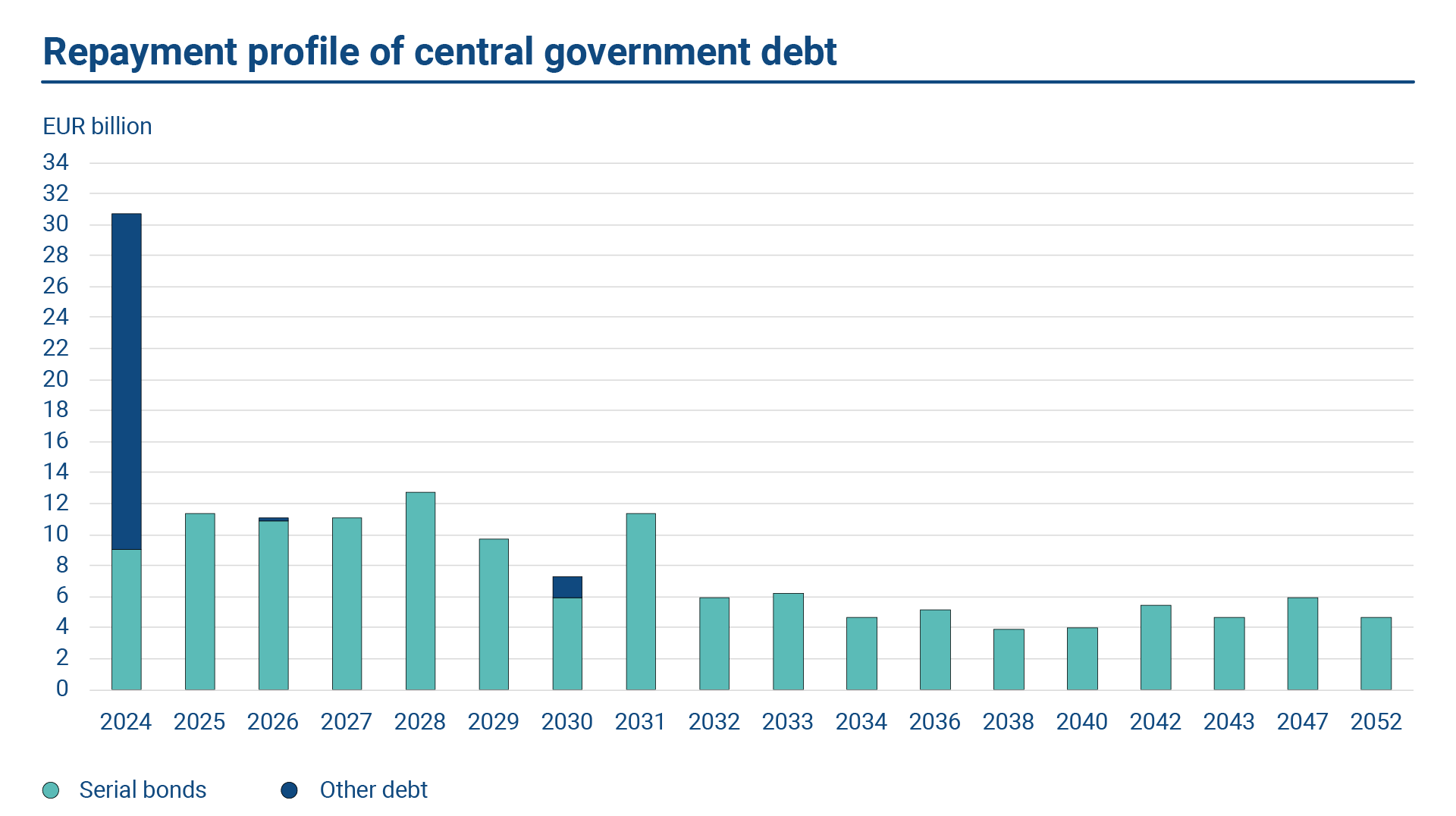

Financing risk can be divided into refinancing risk and liquidity risk. The former is generally measured by the amount of required refinancing, for example, during a year. However, financing risks are also affected by other factors, especially the need to ensure adequate and diverse sources of funding. The latter refers to the risk associated the central government short-term financing needs compared to its liquid cash funds and funding capability.

The State Treasury manages refinancing risk first and foremost by avoiding large maturity concentrations of debt subject to limits by Ministry of Finance. Refinancing risk can also be alleviated by diversifying funding in different instruments, investor types and geographic areas. This reduces the risk associated with an individual source of funding and improves the liquidity and attractiveness of government bonds to investors.

The State Treasury manages liquidity risks by keeping a sufficient cash buffer. This buffer will be larger if uncertainty related to the availability of funding is perceived to rise. For example, during the Covid-19 outbreak, the size of the cash buffer grew considerably. Liquidity can typically be added quickly with short-term funding.

Liquidity risk management is based on the central government cash flow forecast system. In practise, the cash reserves are invested in collateralised or low-risk short-term maturities using primarily bank and central bank deposits. For the time being, the State Treasury can also make short-term deposits in the Bank of Finland.

Market risk

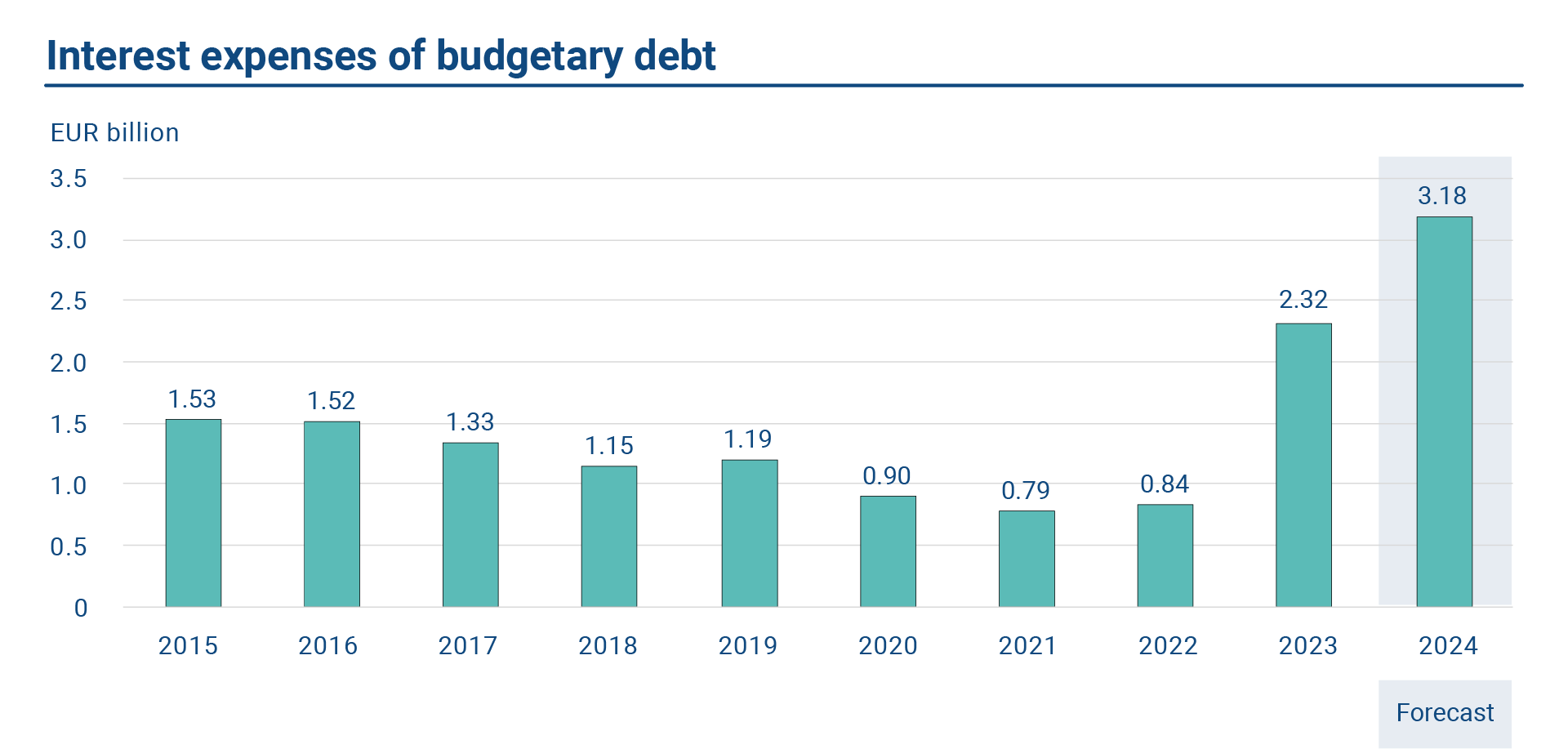

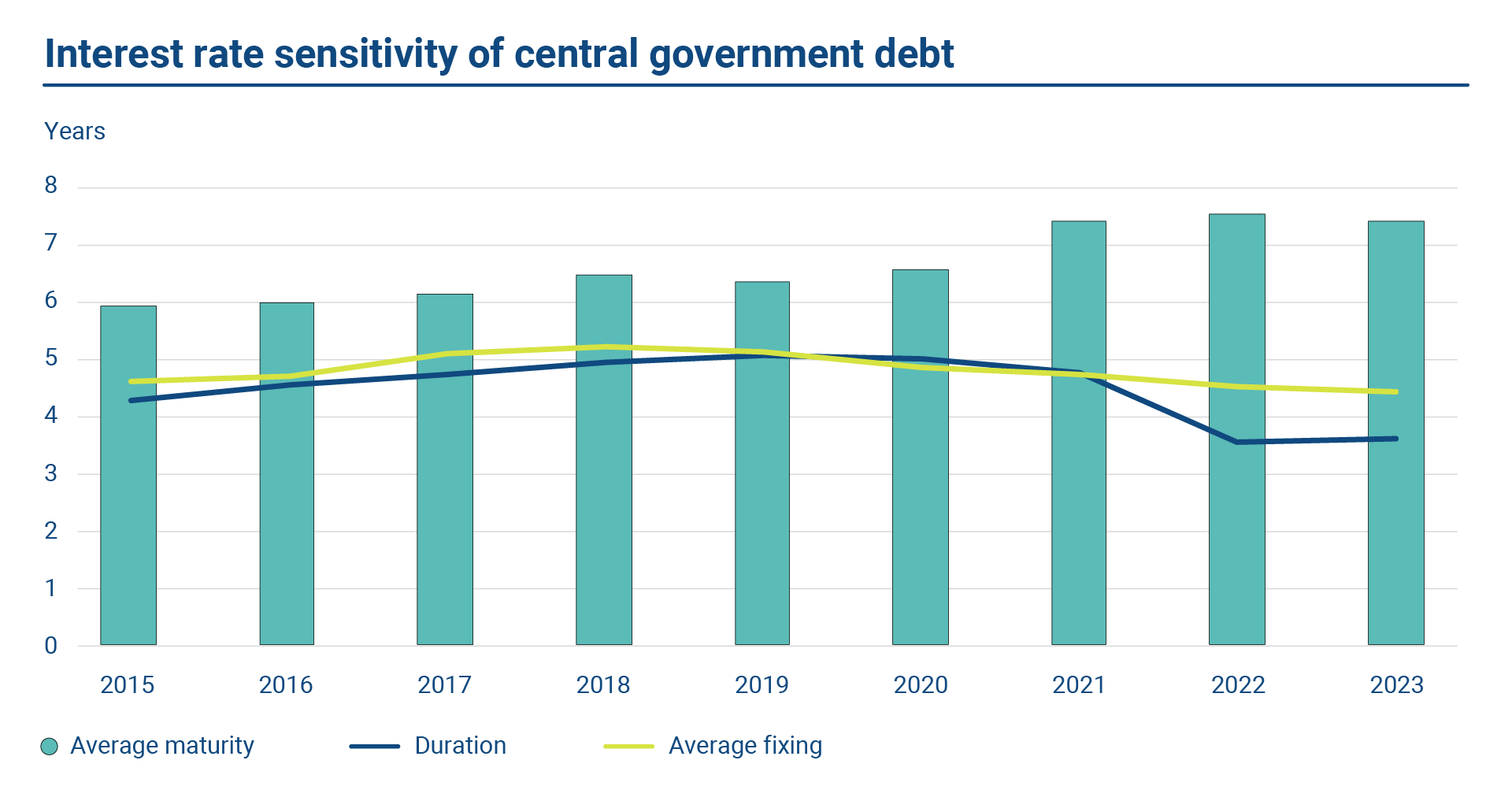

Market risk includes interest rate risk and exchange rate risk. The key indicator of the interest rate sensitivity of central government debt is average fixing. This indicator represents the average time (in years) after which the debt will be repriced. The shorter the period, the faster any changes in interest rates are reflected in the government’s debt expenditure.

The State Treasury manages the central government’s interest rate risk position primarily with interest rate swaps. These were used to maintain the interest rate risk position within its target with no significant changes occurring in market exposure during the year. At the end of 2023, the average fixing for central government debt was 4.44 years.

In Finland, the average fixing of debt is shorter than the average maturity, which is due to a policy choice of shortening the interest rate risk position with interest rate swaps. This choice arises from the typical term structure of interest rates. The interest rate curve, or yield curve, is generally upward sloping, i.e., short-term interest rates are lower than long-term interest rates. This leads to conclusion that a relatively short- interest rate strategy generates less interest expenditure than a longer one. On the other hand, a shorter interest rate risk position can produce greater variation in interest expenditure relative to a longer rate strategy. Chapter 9 provides more on this topic.

The central government takes no exchange rate risk in debt management operations. There was no exchange rate risk relating to the outstanding debt at the end of 2023.

Credit risk

Credit risk arises from cash fund investments and market values of derivative positions. Credit risk is managed with limits and collateral with respect to both cash investments and market values of derivatives. The government requires high counterparty credit ratings and the guidelines set by the Ministry of Finance define minimum credit ratings. Investing cash with triparty repo contracts is a means to reduce credit risk associated with cash investments.

The State Treasury uses cash collateral to reduce the credit risks arising from the market values of derivatives. Like many other sovereign borrowers, Finland uses collateral agreements under the ISDA agreements (CSA, Credit Support Annex). These are two-way collateral agreements where both parties are obliged to provide collateral against the market values of derivative positions.

Operational risk

Operational risk means a risk arising from external factors, technology, or the deficient functioning of personnel, organisation or processes. A field requiring special attention is data security including securing both documents and IT systems. Equal focus is given to developing and continuously testing operative business continuity plans. Periodic audits by external cybersecurity experts have also spurred improvements in operative processes.

The principles of operational risk management are implemented in daily operations. Incidence of risk events and close calls are compiled and reported to management. The State Treasury monitors risk factors and events regularly and makes risk assessments.

Legal risk

Legal risk is the risk resulting from failure to comply with laws and regulations or established market practices as well as invalidity, nullity, voidability, discontinuation or the lack of documentation of contracts, agreements and decisions.

The State Treasury has prepared a set of internal guidelines for the management of legal risks. The State Treasury actively monitors its legal operating environment and reacts to significant changes quickly when necessary.

The objectives of legal risk management are to ensure compliance with applicable laws, rules and regulations and to minimize legal risk by utilising standard agreements and the government’s own templates. In addition, steps are taken to ensure that employees are familiar with legislation, regulations and market practices concerning their activities.

Internal control

Internal control is an integral part of management of the State Treasury. Internal control ensures that operative functions are effective and efficient, internal and external reporting is reliable and laws and regulations are complied with. A sound system of internal control helps all parts of the organisation to reach their targets.

As part of internal control all main debt management processes are evaluated on an annual basis. The assessment pays special attention to the clarity of objectives, risks and control procedures.