Finland has typically favoured a shorter interest rate risk strategy compared to other eurozone countries. This is not the only reason, however, for the rapid increase in the Finnish government’s interest-related expenditures as interest rates have risen. In the next few years, Finland’s financing costs will rise from a low baseline to near the average level of other eurozone countries.

The European Central Bank has raised its interest rates for the last two years, leading to an increase in market interest rates as well as the Finnish government’s interest expenditures on debt. The amount of debt is estimated to increase while Finland’s long-term growth prospects are anticipated to weaken. The changes in Finland’s operating environment and rising interest rates provide grounds for reviewing Finland’s debt management strategy.

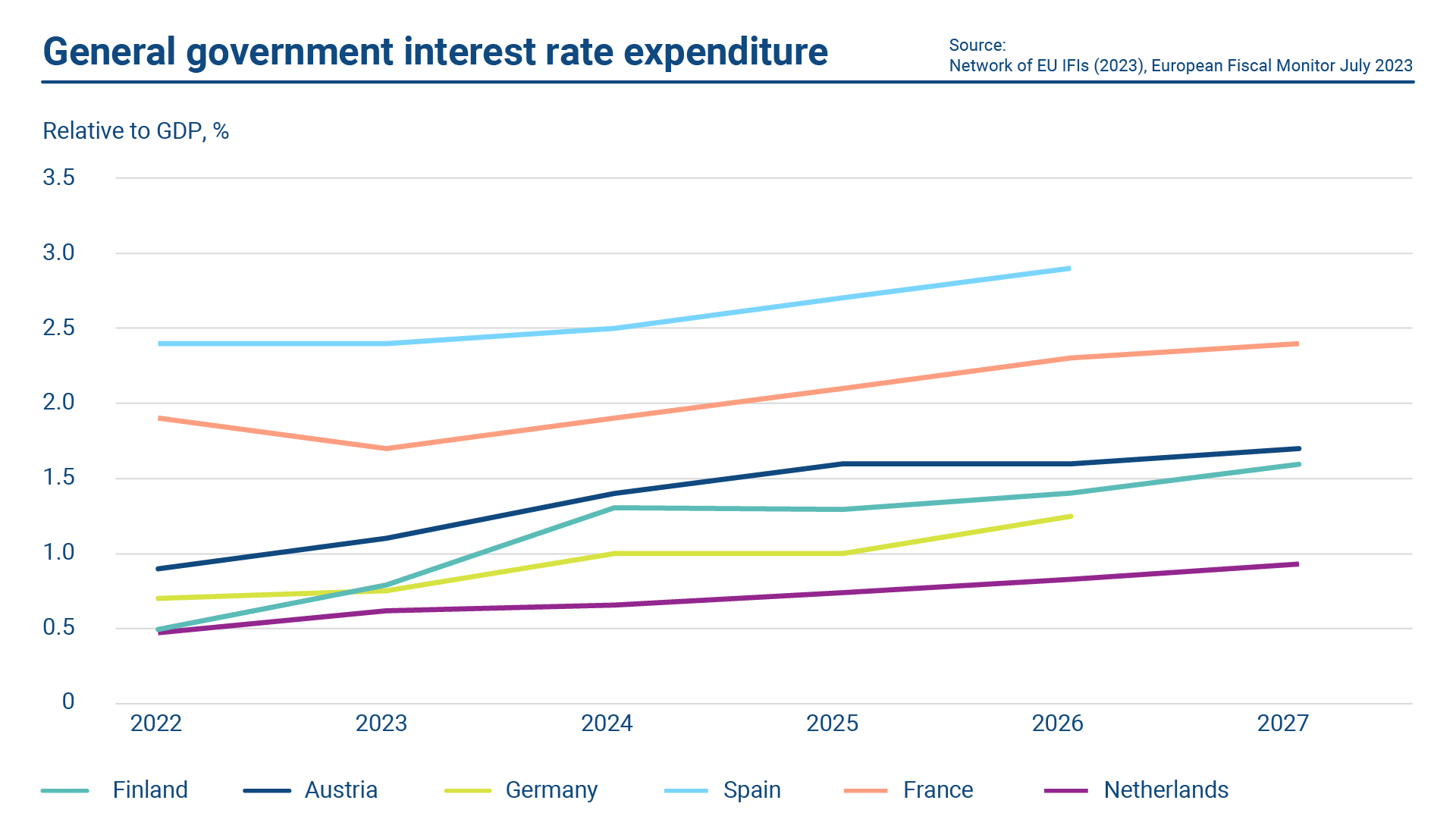

The primary objective of the central government’s debt management is to safeguard Finland’s financing and liquidity in all situations. In reality, the Finnish government funding has not significantly deviated from the funding carried out by other euro-area countries. By using interest rate swaps Finland has been able to simultaneously achieve its desired interest rate risk position while funding in maturities where investor demand has been the highest.

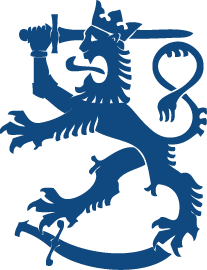

As a result of Finland’s shorter interest rate risk position, the country’s interest expenditures have grown faster than in other eurozone countries as interest rates have risen. Another reason for Finland’s higher level of interest expenditure is that the central government’s deficits are larger than in other eurozone countries. These deficits contribute to the increase in interest expenditures, as they are financed with new debt whose cost is determined by the interest rate prevailing at the time of financing. On the other hand, by choosing a shorter interest rate risk strategy Finland’s central government has been able to benefit from low interest rates over a longer period of time when comparing interest expenditure to other eurozone countries, also to those with a higher credit rating. In the coming years, Finland’s interest expenditure is expected to rise from a low baseline to roughly the eurozone’s average level.

While a shorter interest rate risk strategy typically results in lower interest expenditure on average, it also entails more variation in the interest expenditure. However, the cost difference between different interest rate strategies is so significant that a shorter strategy is practically always cheaper when examined over a period spanning several years. In 2021, a working group established by the Ministry of Finance to assess the central government’s debt management model concluded that the cost of central government debt should be examined over the long term.

Long interest rate risk strategy also entails financial risks.

An often overlooked aspect of a long interest rate risk strategy is that it also entails financial risks. However, in order to understand these risks, a broader perspective taking debt sustainability into account is required. It is essential to see that a higher volatility of interest expenditure does not necessarily mean a higher volatility in deficits.

When interest rates rise continue to rise, opting for a longer interest rate risk strategy means fixing debt interest to a higher level over a longer period of time. Interest rates tend to fall in a recession, which is precisely when the central government’s deficits would otherwise typically increase. In such scenarios, a shorter interest rate risk strategy supports the government’s ability to engage in a countercyclical economic policy. Finland’s interest rate strategy boosted its central government finances especially during and after the financial crisis of 2008.

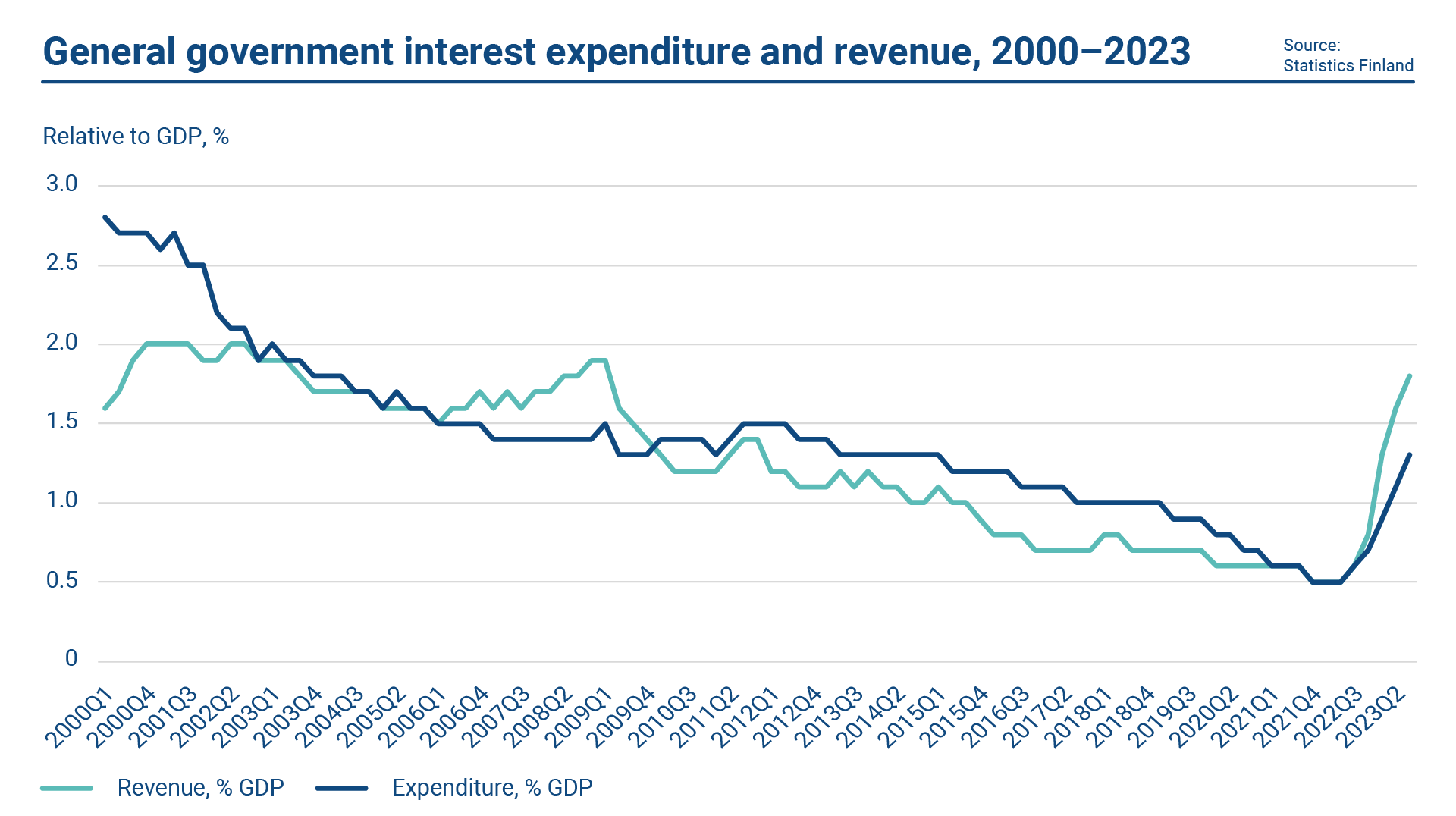

A broader perspective is useful given the significant amount of interest-bearing assets of the general government. As interest rates have risen, the Finnish general government’s interest revenue has increased at a faster pace than its interest expenditure, resulting in a positive net impact for Finland’s public finances. On the other hand, if the central government were to choose a longer interest rate risk strategy, a fall in interest rates could lead to negative net interest revenues and a blow to public finances. From this perspective, a shorter interest rate strategy may stabilize the development of net interest revenues and thus reduce the risks to general government finances. Special attention should be paid to this prospect, especially when the economic outlook is expected to deteriorate.

Finland’s debt stock has grown and is expected to continue to grow in the near future. For this reason, the choice of the interest rate risk strategy has more economic significance than ever before. In this scenario, strategic debt management decisions should be made in a prudent fashion to ensure the long-term sustainability of the central government’s debt.