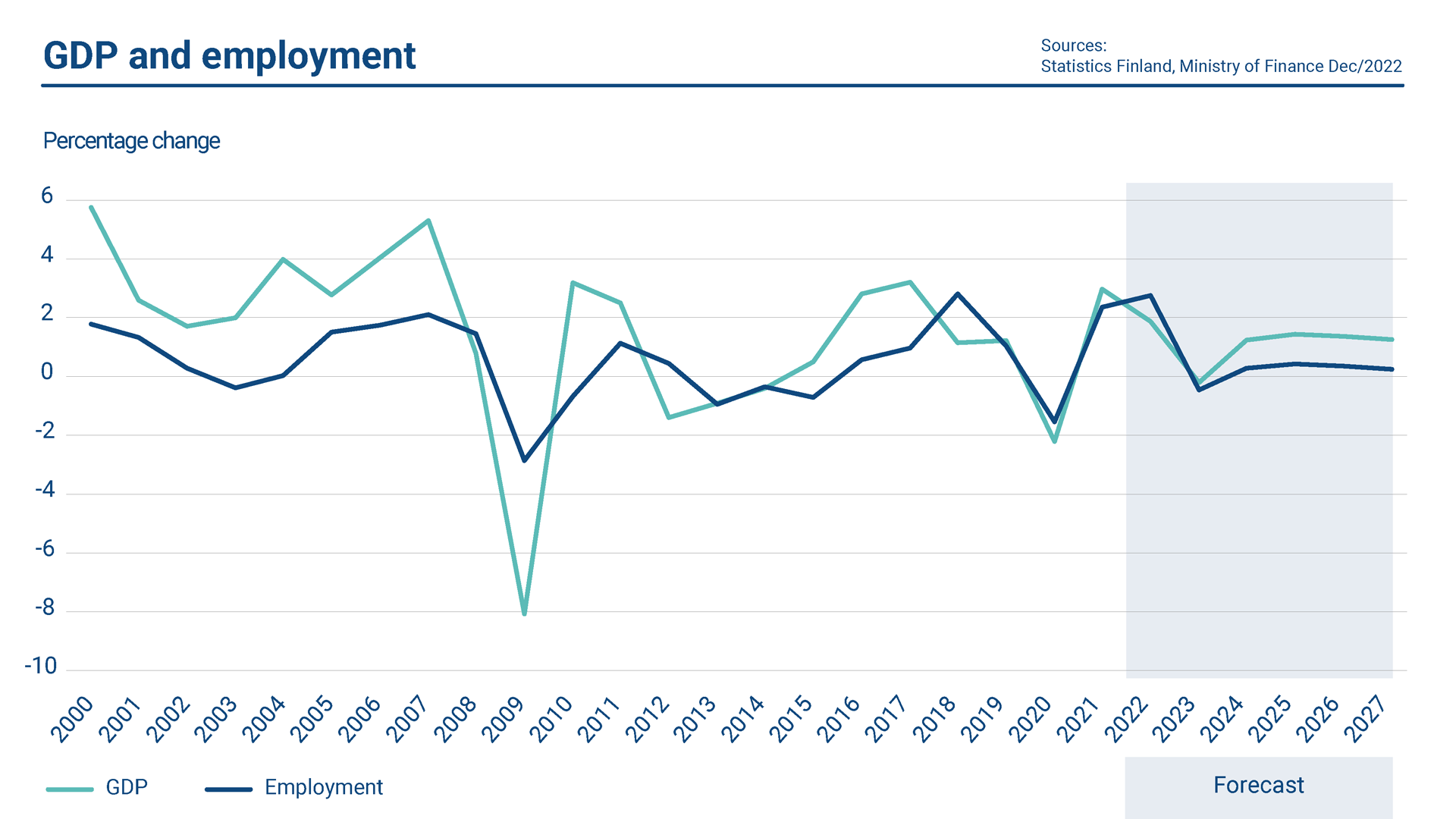

Finland’s GDP is expected to have grown by 1.9 per cent in 2022. Exports, domestic consumption and investments all increased in 2022. While economic growth slowed down in the latter part of the year, the growth in employment continued. At the end of 2022, Finland’s employment rate was at record-high.

Russia’s invasion of Ukraine significantly increased the prices of energy in the spring of 2022 from levels that were already high. The broad-based rise in prices cut household purchasing power as incomes did not keep pace with prices. In Finland, the average inflation rate was 7.1 per cent in 2022.

Public finances

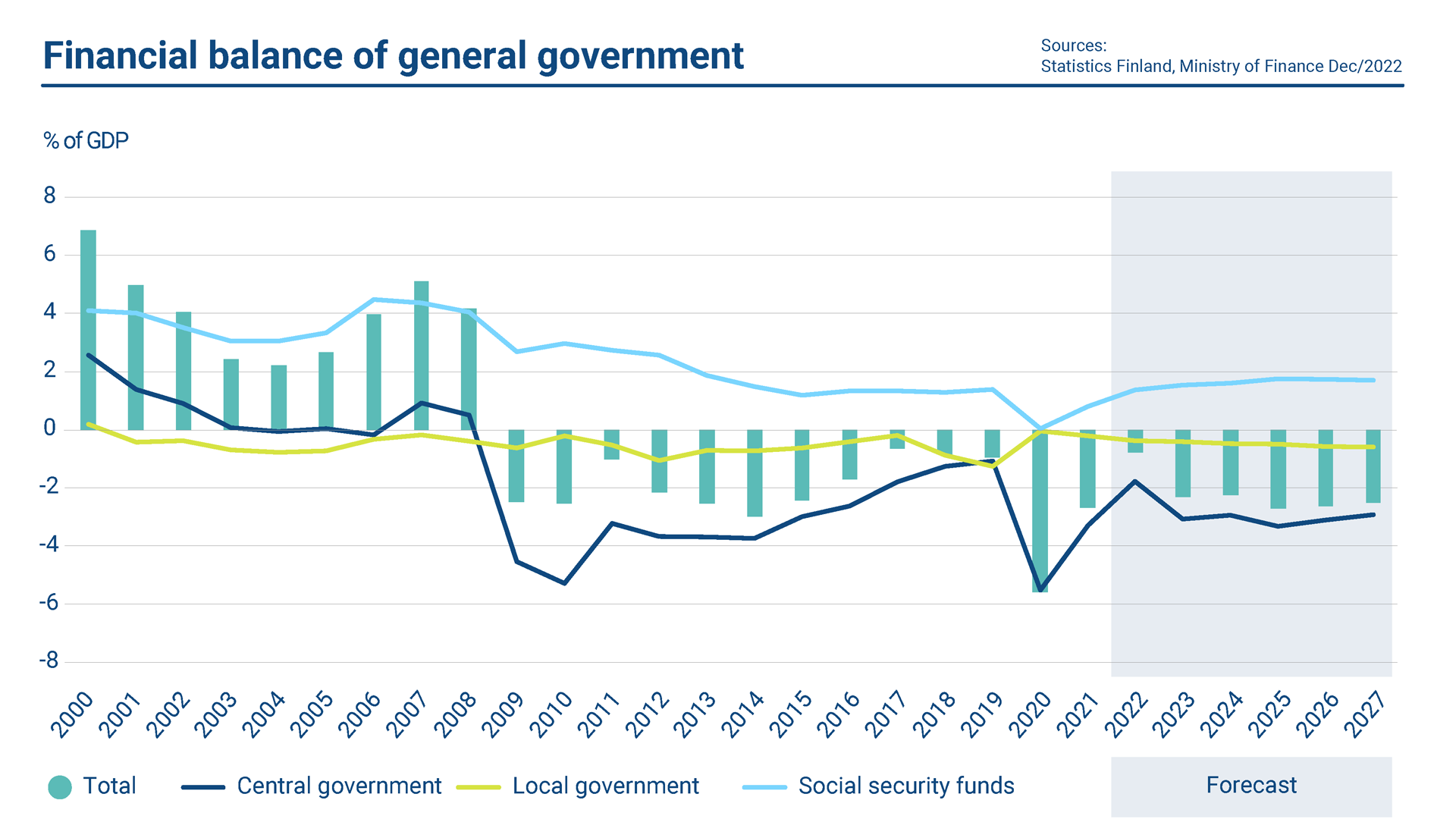

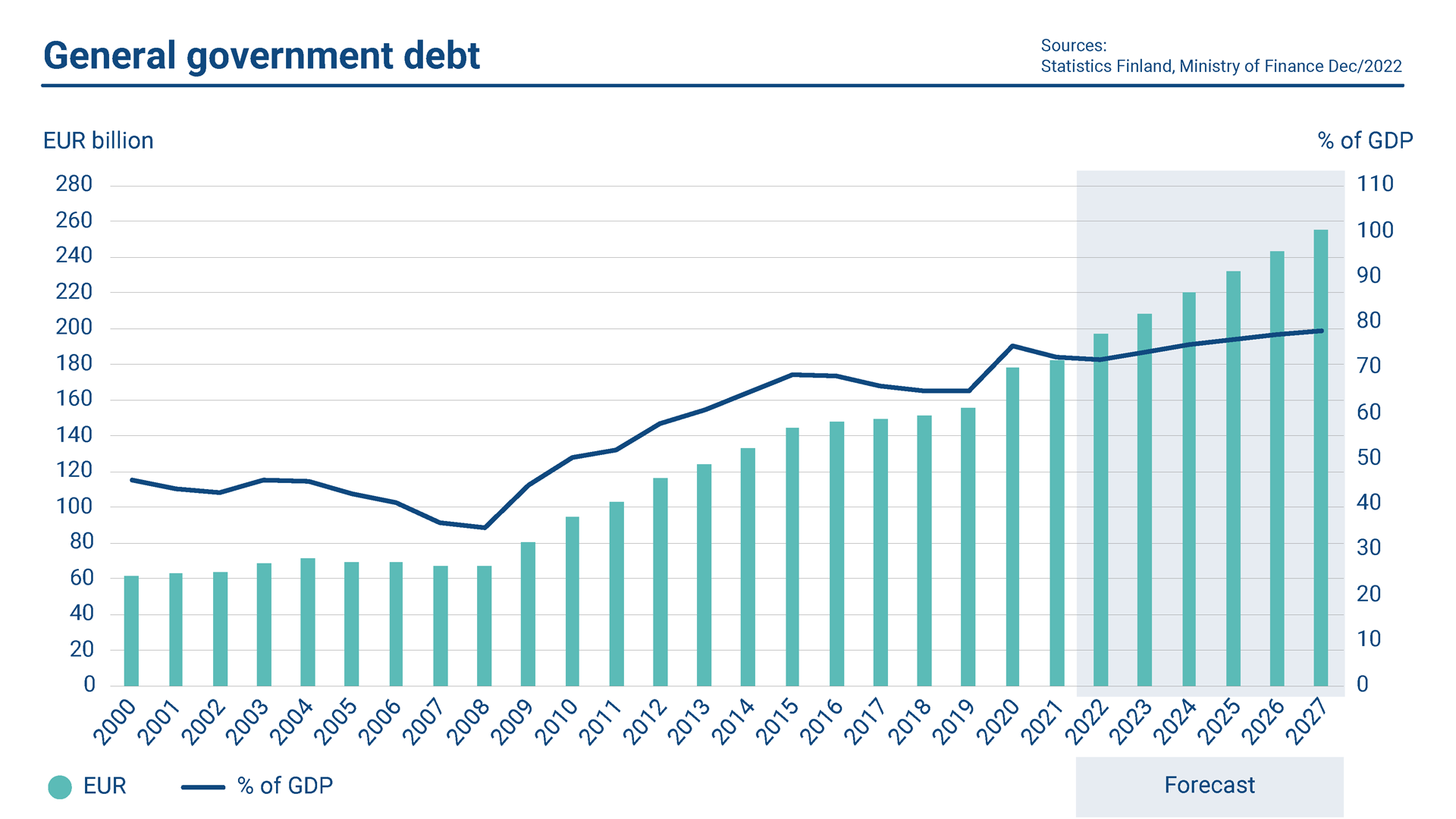

The general government deficit was reduced in 2022 by the strong growth of the economy and employment. The growth in tax revenue was substantial at 7.7%, while expenditures arising from the management of the COVID-19 pandemic were much lower than in the previous years. Supported by strong nominal GDP growth, the general government debt in ratio to GDP has decreased over the past couple of years. However, the Ministry of Finance predicts that it will begin to increase again from 2023 onwards. The debt ratio will be kept on an upward trajectory by substantial deficits in central government and local government, and rapidly rising debt servicing costs.

The general government deficit declined significantly in 2022 compared to the deficit seen in the previous year. According to the forecast of the Ministry of Finance, the general government deficit was 0.8% of GDP in 2022. The general government gross debt stood at 71.7%. This represented a rather modest decline from the previous year. The estimate for the central government debt was 51.6% of GDP at the end of 2022, while the deficit accounted for 1.8%.[1]

Finland’s relatively strong public finances, competitive economy and high governance indicators, among other things, are reflected in Finland’s high credit ratings. The central government of Finland has solicited credit ratings from two credit rating agencies: Fitch Ratings and S&P Global Ratings. For long-term debt, they are AA+ with stable outlook from both credit agencies.

[1] All estimates are from the Ministry of Finance’s Economic Survey, Winter 2022.

Interest rate developments

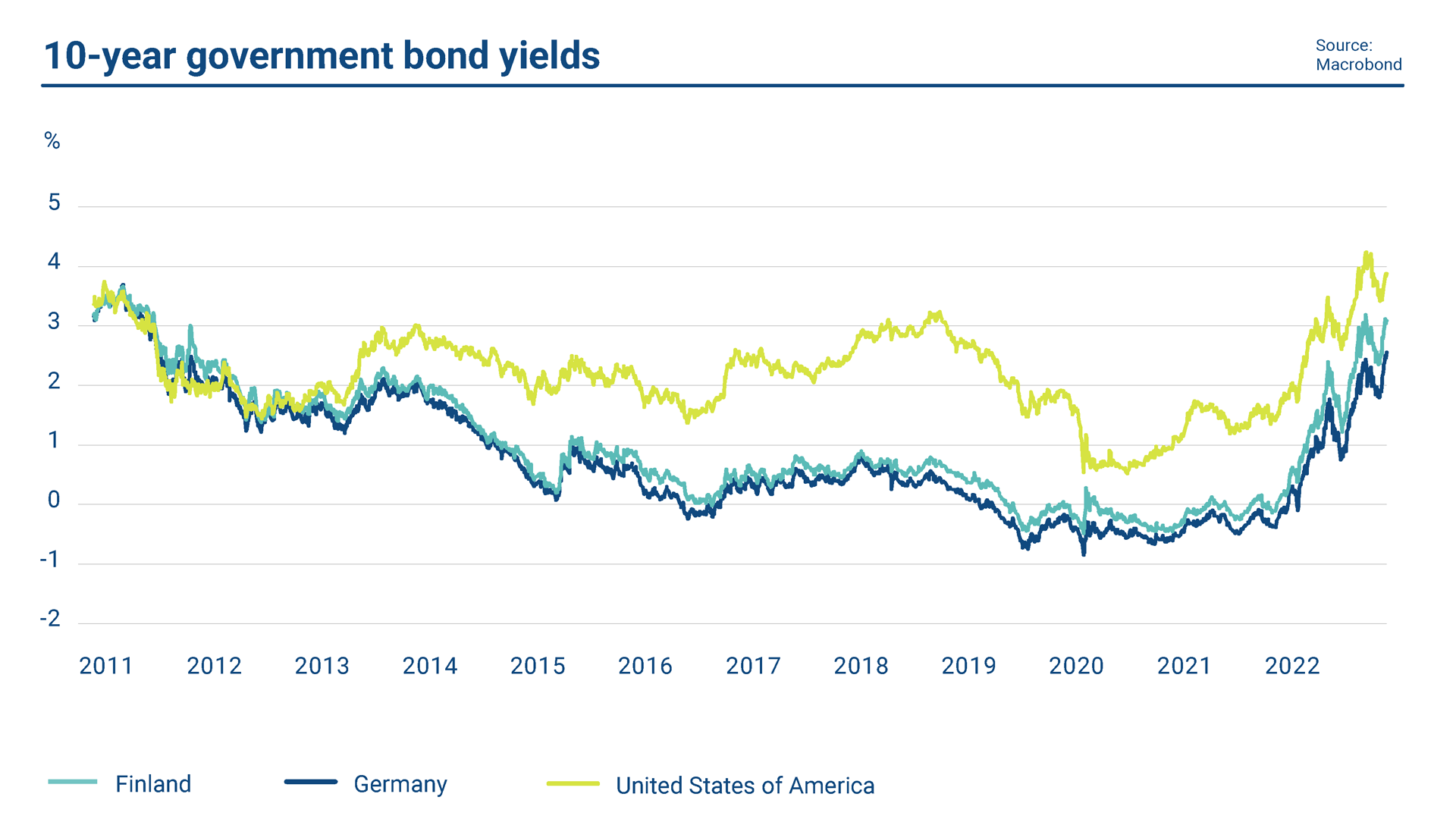

The year 2022 can be described as a violent one, both in the financial markets and on European soil. The energy market crisis emerging from the Russian invasion of Ukraine, combined with bottlenecks in the global supply chains, set inflationary developments on a path unprecedented in decades, and induced a drastic turn in central bank monetary policies both in the United States and Europe. The Federal Reserve hiked its main policy rate by over 4 percentage points and the European Central Bank (ECB) by 2.5 percentage points during the year to prevent inflation becoming entrenched. As a result, government bond yields skyrocketed during the year – on both sides of the Atlantic – making it an exceptionally poor one for bond investors, at the same time when equity markets widely underperformed on inflationary concerns.

Shifts in government bond secondary market rates have reflected changing market perceptions of central bank policy rates’ terminal values in the current hiking cycle, which evidently is not over at the time of writing. As the ECB ceased net monetary policy purchases of government, agency and corporate securities, bond supply became increasingly a market driver as many governments in Europe sought to implement support measures for consumers and prepare for contingencies. Since July 2022 only re-investments of the existing ECB monetary policy bond portfolio have taken place, with some flexibility across jurisdictions to preserve and safeguard monetary policy transmission in the euro area. In practice this flexibility has remained more a principle than an active tool.

As aggressive monetary policy tightening is increasing the risk of an economic recession, government yield curves have turned downward sloping in many markets during the latter half of 2022, both in the largest European ones and the U.S, as well as for Finland.

Secondary market developments

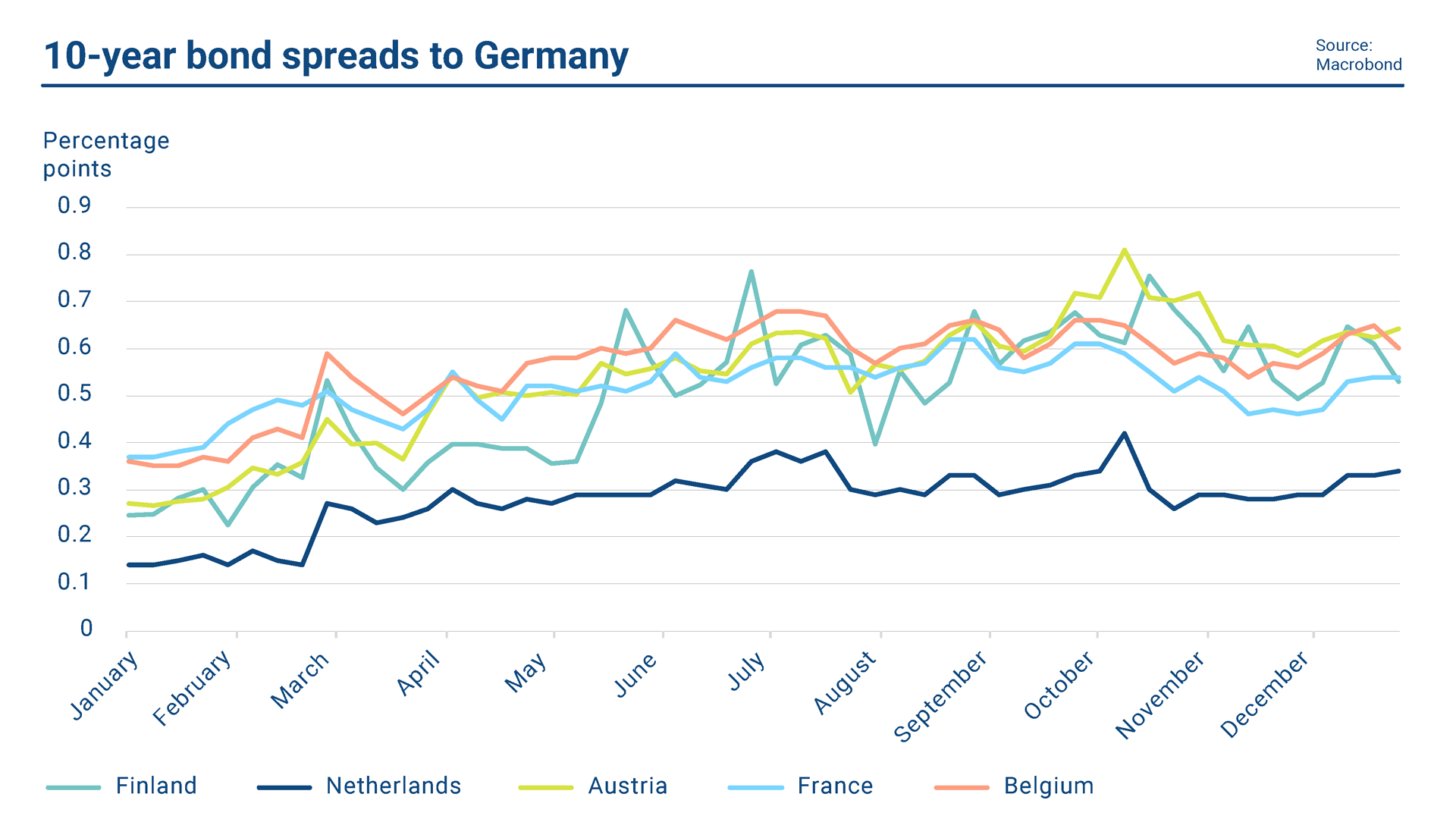

Despite fiscal deficit contracting relative to GDP, there was more net supply of Finnish government bonds (RFGB) in 2022 compared to 2021. However, bond yield spread versus Germany widened during the first half of the year along European peers as uncertainties mounted and market liquidity deteriorated. Subsequently the 10-year yield spread to Germany has remained close to mid-year levels, first widening in Q3 and the tightening in Q4. In 2022 the RFGB offered yield pick-up over the Netherlands and in the latter half of the year over France, while remaining tighter to the EU and broadly in line with Austria. In absolute terms there were significant yield shifts, as the current 10-year RFGB yielded below 0.2 % in early January and 3.1% at the end of the year.

Secondary market liquidity for RFGBs, i.e. the euro benchmarks, was affected by the overall volatility and uncertainty the European sovereign debt markets and deteriorated more than that of larger markets, particularly the ones featuring futures contracts. Some signs of repo specialness were observed, especially for some off-the-run bonds in the shorter end of the yield curve towards the end of the year.

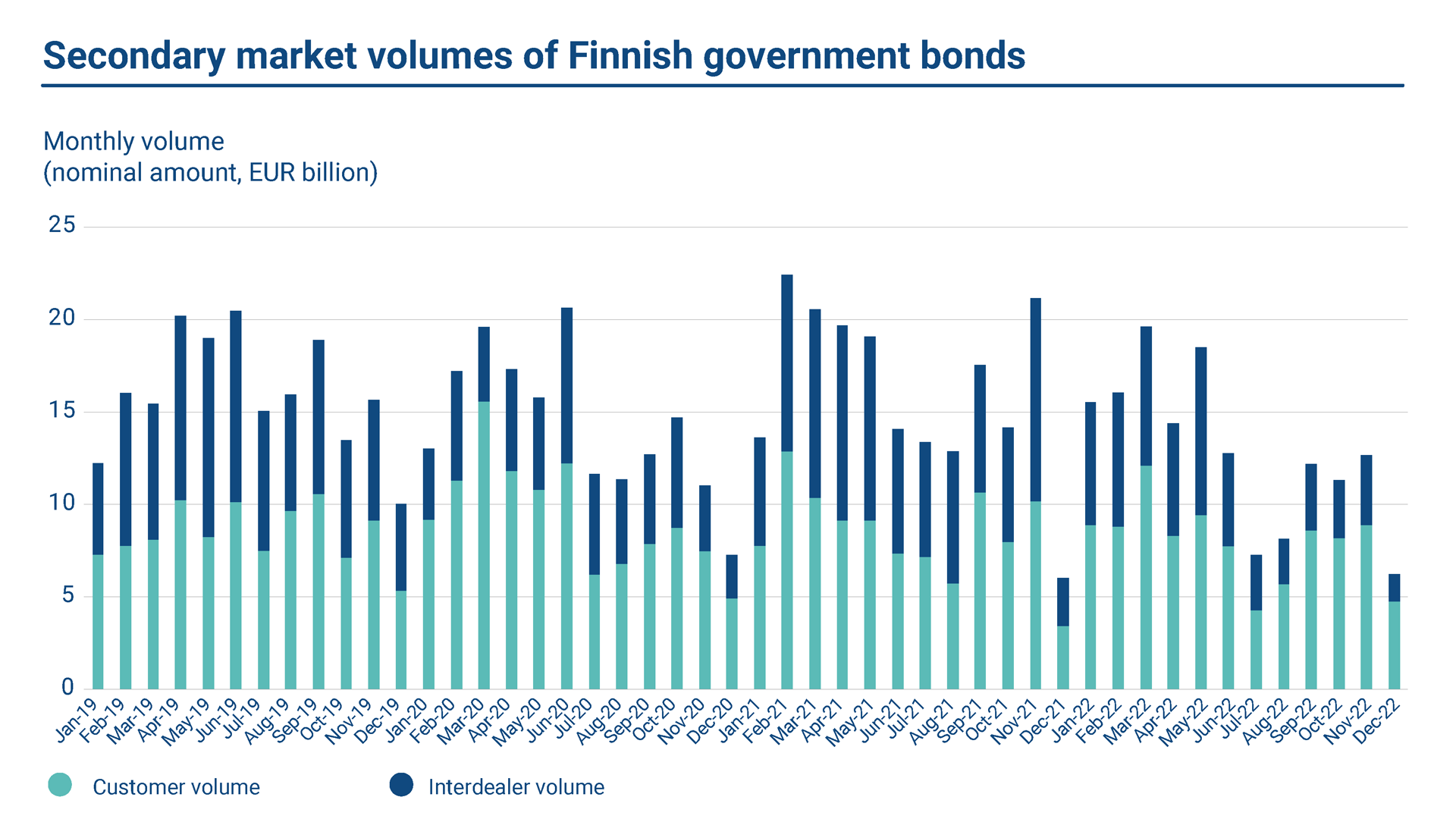

It is a priority for the State Treasury to work actively with the primary dealers to maintain and further enhance the liquidity of the Finnish government bonds. Finnish government benchmark bonds can be traded on the following interdealer platforms: MTS Finland, BGC eSpeed, and ICAP BrokerTec. The State Treasury does not participate in secondary market activity, and the interdealer trading is based on the activity of the primary dealers and other market participants. In 2022, the nominal interdealer trading volume was on average EUR 4.9 billion per month (EUR 7.7 billion in 2021).

It is a priority for the State Treasury to work actively with the primary dealers to maintain and further enhance the liquidity of the Finnish government bonds. Finnish government benchmark bonds can be traded on the following interdealer platforms: MTS Finland, BGC eSpeed, and ICAP BrokerTec. The State Treasury does not participate in secondary market activity, and the interdealer trading is based on the activity of the primary dealers and other market participants. In 2022, the nominal interdealer trading volume was on average EUR 4.9 billion per month (EUR 7.7 billion in 2021).

The State Treasury actively follows the primary dealer quoting activity in the secondary markets. There are guidelines for the Primary Dealers on quoting for different maturities in the interdealer market, where the bid-offer spread of the price quotes is observed and tracked. The average bid-offer spread of all the market makers is calculated and each Primary Dealer benchmarked against the average. On a weekly basis, the State Treasury reports the analysed spread data for the benchmark bond quotes back to the individual Primary Dealer banks. In 2022, there was a deterioration in the bond interdealer market conditions from end of February onwards, and the interdealer market bid-offer spreads widened accordingly especially in the latter half of the year.

Primary dealers report customer trade volumes to the State Treasury within the Euro Market Activity Reporting (EMAR). The reporting takes place on a monthly basis, and the data is consolidated and used for monitoring and analysis. According to the EMAR data, the overall secondary market customer turnover volume decreased slightly in comparison to 2021. The yearly turnover in total was EUR 95.75 billion. The average monthly turnover (sales and purchases) was EUR 8.0 billion in 2022 (EUR 8.5 in 2021). In relative terms, the monthly average turnover volume was 7.5% of the total outstanding euro benchmark bond stock (8.2% in 2021).